Question: the boxes in green please Data Window Help Risk Cha! Excel File Edit View Insert Format Tools AutoSaver . Home Insert Draw Page Layout Formulas

the boxes in green please

the boxes in green please

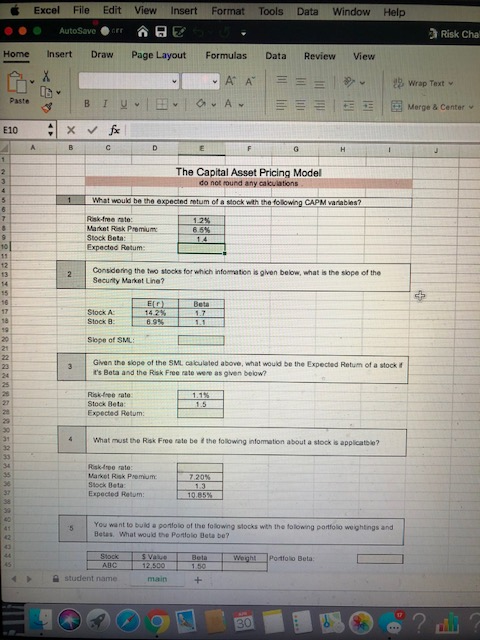

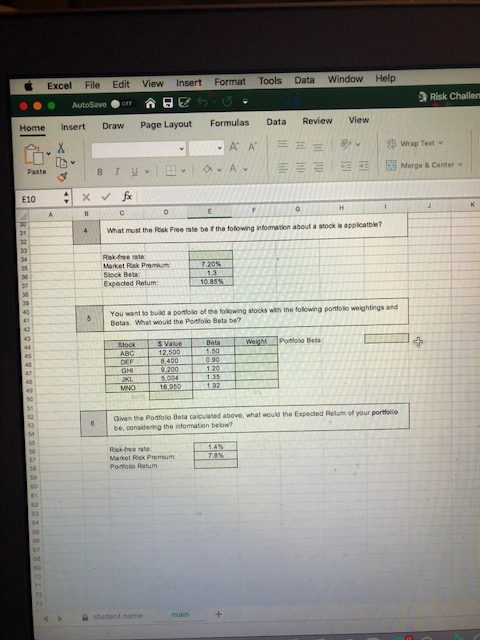

Data Window Help Risk Cha! Excel File Edit View Insert Format Tools AutoSaver . Home Insert Draw Page Layout Formulas Data A A = 8 Bivolova.A - View Review == Wrap Text Merge Center E10 x B fx . The Capital Asset Pricing Model do not found any calculations What would be the expected retum of a stock with the following CAPM variables 12% Risk-free rate: Market Risk Premium Stock Bota Expected Patum: Considering the two stocks for which information is given below, what is the slope of the Security Market Lina? Stock A Stock Slope of SML Given the slope of the SML calculated above, what would be the Expected Return of a stock It's Bota and the Risk Free rate w a s given below? OEN XXNNNNXBs Risk free rate Stock Beta: Expected Rotum: What must the Risk Free rate be the following information about a stock is applicable? Risk-free rate Market Risk Premium Stock Bota Expected Ratum: 17.20% 10.85% You want to build a portfolio of the following stocks with the following portfolio weightings and Betes. What would the Portfolio Beta be? Stock s Vie Bela Weight Portfolio Bota: AUC 12.500 150 student name main Help Risk Challe Excel File Edit View Insert Format Tools Data Window ... Autosave U Home Insert Draw Page Layout Formulas Data Review View th VAN = = BIVAA 15 Wrap Text Merge & Center E10 x fx What must the Risk Free rate of the folowing information about a stock is applicable? Rise Market Rok Premium Stock Beta Expected tum: You want to build a portfolio of the following stocks with the following portfolie weightings and Botas What would the Portfolio Beta ba? B ESEDOS o f your portfolio Given the Portfolio Beta calculated above, what would the Expected Ro becoming t o be Ristrerate Marko Rs Premium Porto Rotum RSS student name

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts