Question: ^ The boxes seen in this question are fill in the blanks. Suppose you bought a 10 percent coupon bond one year ago for $960.

^The boxes seen in this question are fill in the blanks.

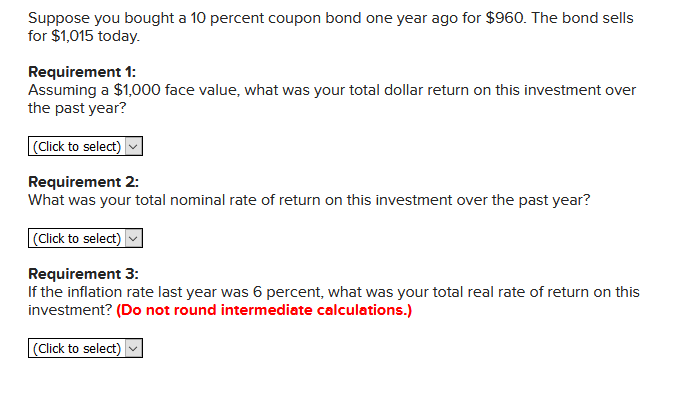

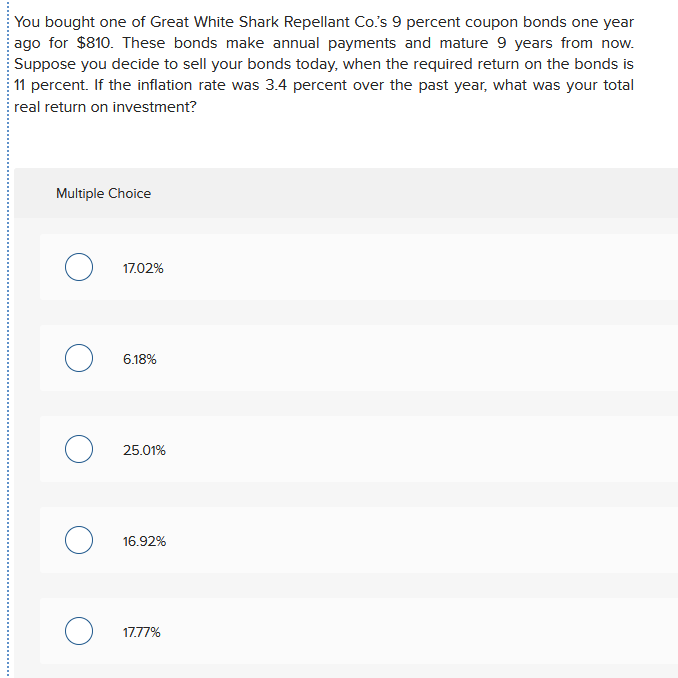

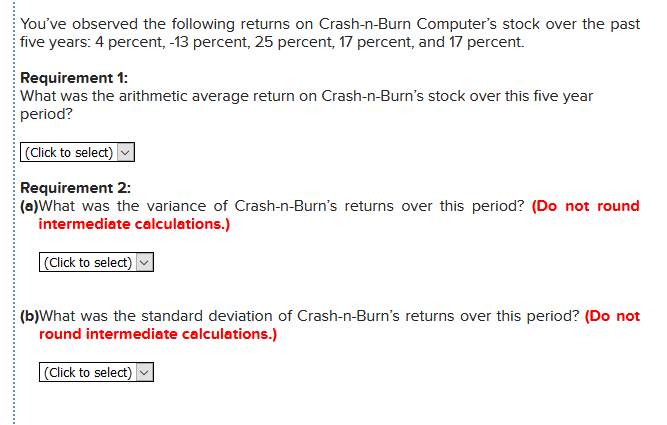

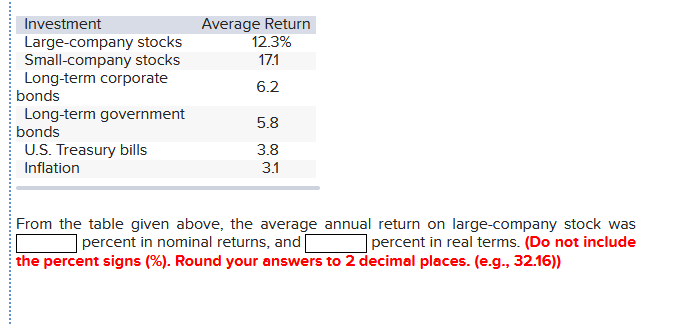

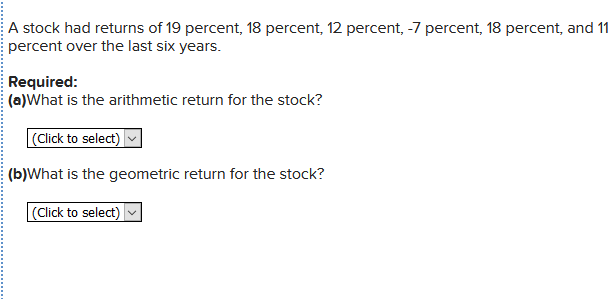

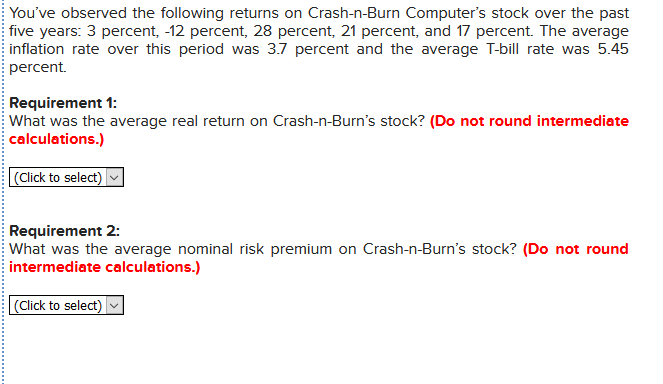

Suppose you bought a 10 percent coupon bond one year ago for $960. The bond sells for $1,015 today. Requirement 1: Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Click to select) Requirement 2: What was your total nominal rate of return on this investment over the past year? (Click to select) Requirement 3: If the inflation rate last year was 6 percent, what was your total real rate of return on this investment? (Do not round intermediate calculations.) Click to select) You bought one of Great White Shark Repellant Co.'s 9 percent coupon bonds one year ago for $810. These bonds make annual payments and mature 9 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 11 percent. If the inflation rate was 3.4 percent over the past year, what was your total real return on investment? Multiple Choice 17.02% 0 618% 6.18% 0 25.01% O 16.92% 16.92% 17.77% You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 4 percent, -13 percent, 25 percent, 17 percent, and 17 percent. Requirement 1: What was the arithmetic average return on Crash-n-Burn's stock over this five year period? (Click to select) Requirement 2: (a)What was the variance of Crash-n-Burn's returns over this period? (Do not round intermediate calculations.) (Click to select) (b)What was the standard deviation of Crash-n-Burn's returns over this period? (Do not round intermediate calculations.) (Click to select) | Average Return 12.3% 17.1 6.2 Investment Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds U.S. Treasury bills Inflation 5.8 3.8 From the table given above, the average annual return on large-company stock was percent in nominal returns, and percent in real terms. (Do not include the percent signs (%). Round your answers to 2 decimal places. (e.g., 32.16)) A stock had returns of 19 percent, 18 percent, 12 percent, -7 percent, 18 percent, and 11 percent over the last six years. Required: (a)What is the arithmetic return for the stock? (Click to select) (b)What is the geometric return for the stock? (Click to select) You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 3 percent, -12 percent, 28 percent, 21 percent, and 17 percent. The average inflation rate over this period was 3.7 percent and the average T-bill rate was 5.45 percent Requirement 1: What was the average real return on Crash-n-Burn's stock? (Do not round intermediate calculations.) Click to select) Requirement 2: What was the average nominal risk premium on Crash-n-Burn's stock? (Do not round intermediate calculations.) (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts