The breakeven point BEP is the point where a company's revenue equals its costs. This point allows you to know when your firm will start to be profitable. So BEP is an important reference point which helps you understand the appropriate amount of product units that need to be sold in a fiscal year.

The following formula are

BreakEven Point Fixed costs Contribution Margin Contribution margin Price Variable costs

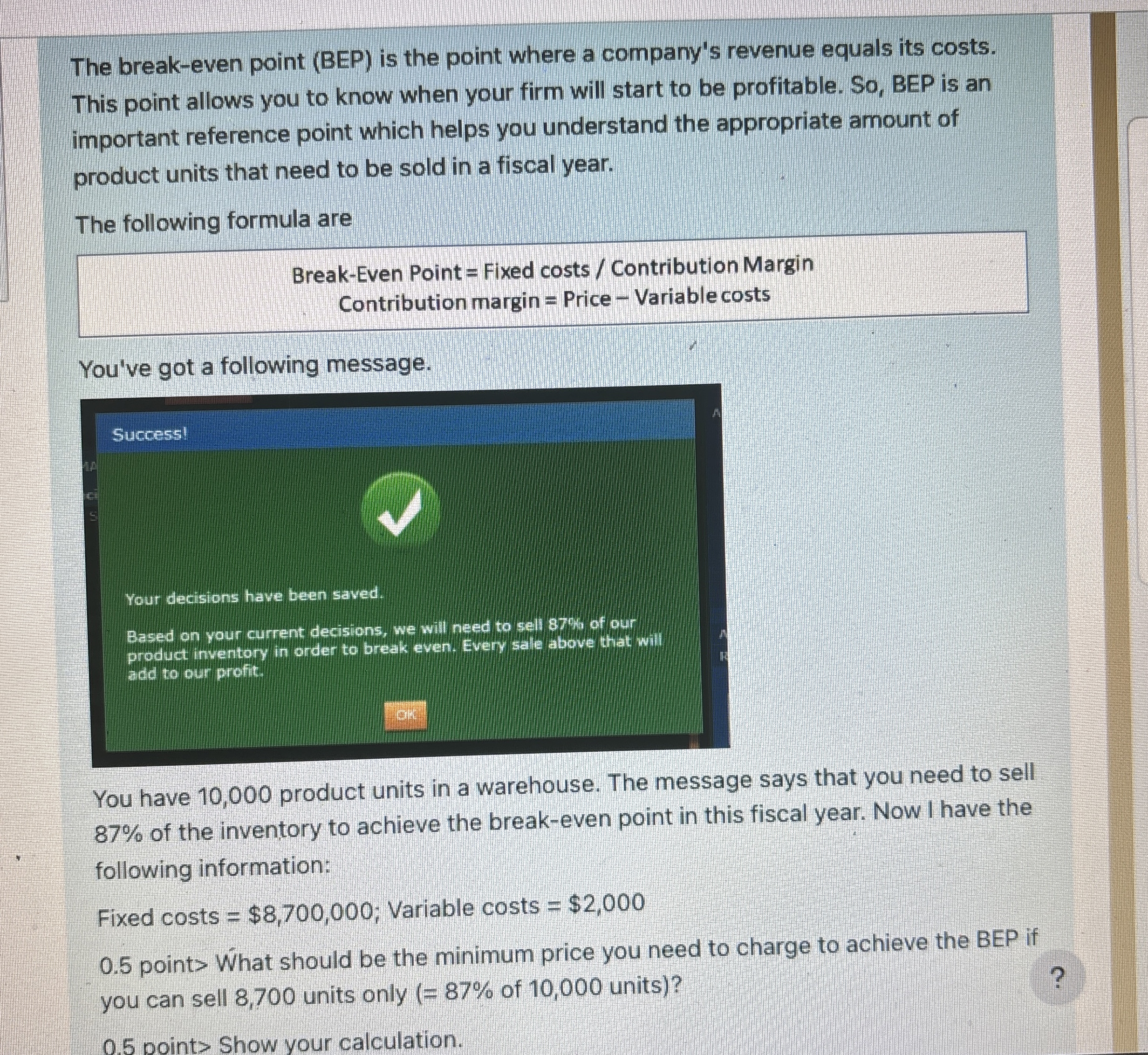

You've got a following message.

Success!

Your decisions have been saved.

Based on your current decisions, we will need to sell of our product inventory in order to break even. Every sale above that will add to our profit:

You have product units in a warehouse. The message says that you need to sell of the inventory to achieve the breakeven point in this fiscal year. Now I have the following information:

Fixed costs $; Variable costs $

point What should be the minimum price you need to charge to achieve the BEP if you can sell units only of units

point Show your calculation.