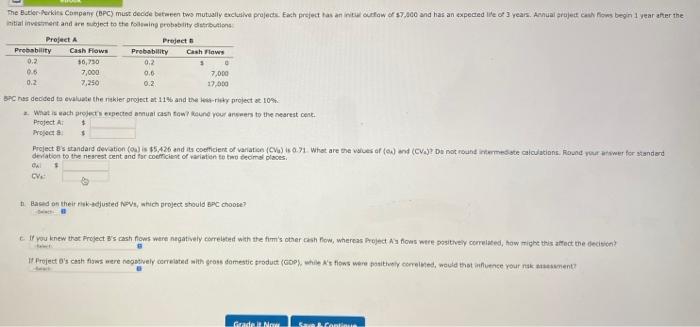

Question: The Butler Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an intulufow of $7.000 and has an expected life of

The Butler Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an intulufow of $7.000 and has an expected life of 3 years. Annual project cows begin year after the Initial investment and are subject to the poing robability darbution Project A Project Probability Cash Flows Probability Cash Flows 0.2 36,750 0.2 0.6 7,000 0.6 7,000 0.2 7,250 0.2 17,000 3PC has decided to evaluate the riskler project at 11% and the project at 10% What is ach projectspected annunt casnow Round your answers to the nearest cent. Project A Project Projects standard devation coulis $5A26 and its coefficient of variation (CV) 0.71 What are the values of (a) and (CV.? Du otround warmediate calculations. Round your wwwer for standard deviation to the nearest cent and for coeficient of variation to two some blaces CA + CV. . Based on their takadjusted NV, which project should BPC choose? If you knew that Project's cash flows were negatively correlated with the firm's other cash row, whereas Project Afons were positively correlated, how might this affect the decision It Project O's cathows were negatively correlated with grom domestic product (GDP), while's flows were positively corree, would that onfuence your nok mant? code Gone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts