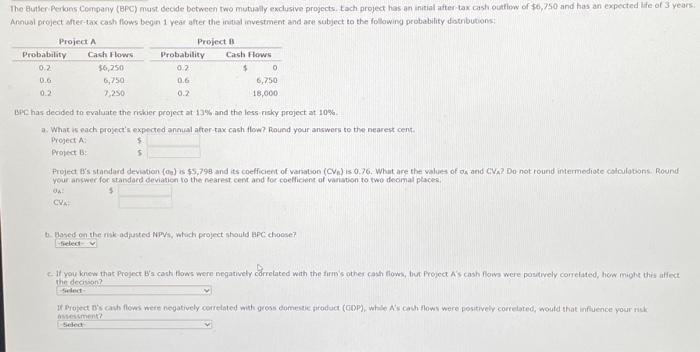

Question: The Butser Perkers Company (BPC) must decide between two mutually exclusive projects. tach project has an initial after-tax casti outlow of s6,750 and thas an

The Butser Perkers Company (BPC) must decide between two mutually exclusive projects. tach project has an initial after-tax casti outlow of s6,750 and thas an expected life of 3 years: Annual project ater-tax cash flows begin 1 year after the inital inyestment and are subject to the following probability dotributions: Bich has decided to evaluate the riskier project at 13% and the less risky project at 10%. a. What is each proyct's expected annual after-tax-cash illowe? Riound your answers to the nearest cent. Project A: Project B: s. your answer for standaed devation to the nearest cent and for coefficient of vainstion to two deomal places, a: 3. CVHI b. Based on the mik adjusted NPVs, which project should aPC choose? C. If wou knew that Project B's cash flows were negatively correlated with the firm's other cash flows, bur Project A's cash flows were positwely correlated, hur imighe this affect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts