Question: The calculations from the Excel Sheet are correct. I would simply like some explanations for the questions. The Voronina Mining Company is considering developing a

The calculations from the Excel Sheet are correct. I would simply like some explanations for the questions.

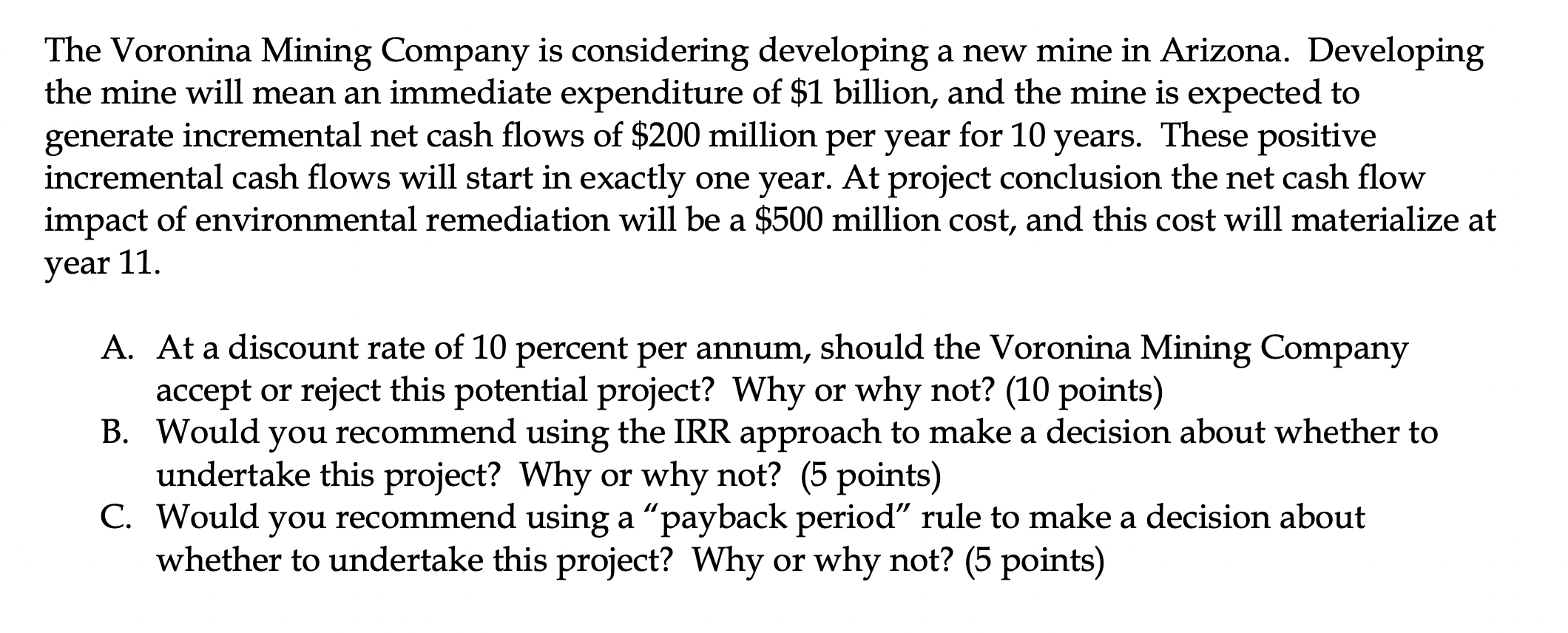

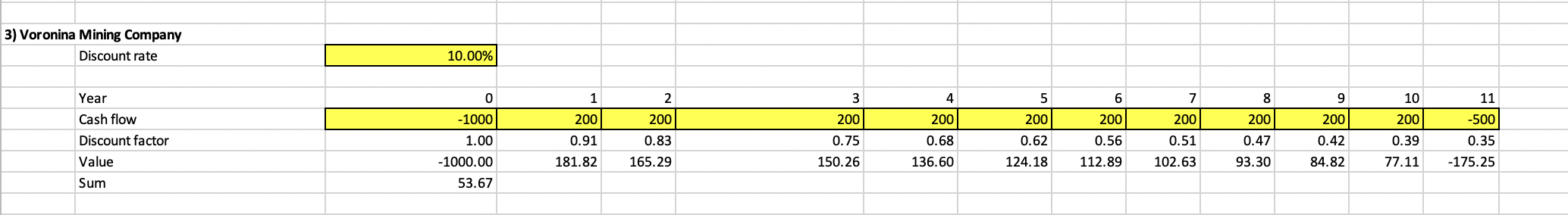

The Voronina Mining Company is considering developing a new mine in Arizona. Developing the mine will mean an immediate expenditure of $1 billion, and the mine is expected to generate incremental net cash flows of $200 million per year for 10 years. These positive incremental cash flows will start in exactly one year. At project conclusion the net cash flow impact of environmental remediation will be a $500 million cost, and this cost will materialize at year 11. A. At a discount rate of 10 percent per annum, should the Voronina Mining Company accept or reject this potential project? Why or why not? (10 points) B. Would you recommend using the IRR approach to make a decision about whether to undertake this project? Why or why not? (5 points) C. Would you recommend using a payback period rule to make a decision about whether to undertake this project? Why or why not? (5 points) 3) Voronina Mining Company Discount rate 10.00% 0 3 4 6 7 1 200 5 200 2 200 0.83 8 200 10 200 200 200 200 Year Cash flow Discount factor Value Sum 200 -1000 1.00 9 200 0.42 11 -500 0.35 0.91 0.68 0.39 0.75 150.26 0.62 124.18 0.56 112.89 0.51 102.63 0.47 93.30 181.82 165.29 136.60 84.82 77.11 -175.25 -1000.00 53.67 The Voronina Mining Company is considering developing a new mine in Arizona. Developing the mine will mean an immediate expenditure of $1 billion, and the mine is expected to generate incremental net cash flows of $200 million per year for 10 years. These positive incremental cash flows will start in exactly one year. At project conclusion the net cash flow impact of environmental remediation will be a $500 million cost, and this cost will materialize at year 11. A. At a discount rate of 10 percent per annum, should the Voronina Mining Company accept or reject this potential project? Why or why not? (10 points) B. Would you recommend using the IRR approach to make a decision about whether to undertake this project? Why or why not? (5 points) C. Would you recommend using a payback period rule to make a decision about whether to undertake this project? Why or why not? (5 points) 3) Voronina Mining Company Discount rate 10.00% 0 3 4 6 7 1 200 5 200 2 200 0.83 8 200 10 200 200 200 200 Year Cash flow Discount factor Value Sum 200 -1000 1.00 9 200 0.42 11 -500 0.35 0.91 0.68 0.39 0.75 150.26 0.62 124.18 0.56 112.89 0.51 102.63 0.47 93.30 181.82 165.29 136.60 84.82 77.11 -175.25 -1000.00 53.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts