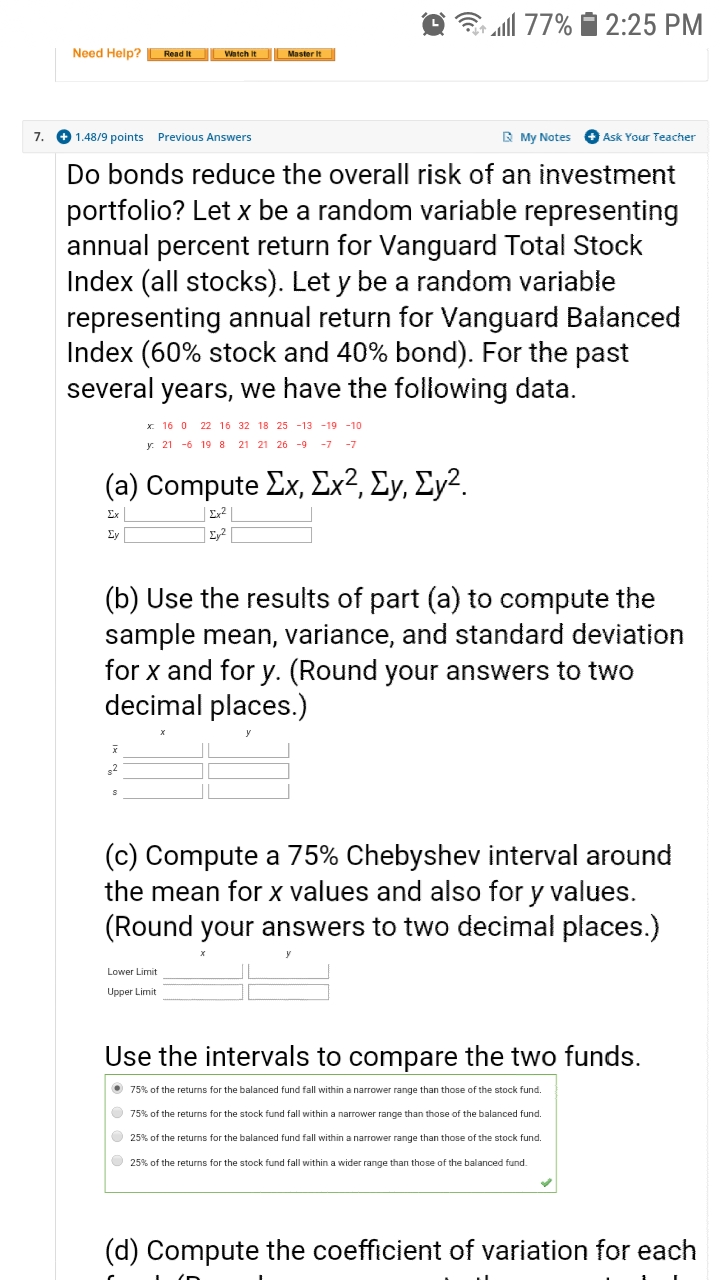

Question: The calculations i keep getting are wrong and this is a complicated question where I struggle with the calculations Part D says compute the coefficients

The calculations i keep getting are wrong and this is a complicated question where I struggle with the calculations

Part D says compute the coefficients of variation for each fund (Round your answers to the nearest whole number.

But alll 77% 2:25 PM Need Help? Read It Watch it Master it 7. + 1.48/9 points Previous Answers My Notes + Ask Your Teacher Do bonds reduce the overall risk of an investment portfolio? Let x be a random variable representing annual percent return for Vanguard Total Stock Index (all stocks). Let y be a random variable representing annual return for Vanguard Balanced Index (60% stock and 40% bond). For the past several years, we have the following data. x 16 0 22 16 32 18 25 -13 -19 -10 V. 21 -6 19 8 21 21 26 -9 -7 -7 (a) Compute Ex, Ex2, Zy, Zy2. Ex Ex 2 Ey (b) Use the results of part (a) to compute the sample mean, variance, and standard deviation for x and for y. (Round your answers to two decimal places.) (c) Compute a 75% Chebyshev interval around the mean for x values and also for y values. (Round your answers to two decimal places.) Lower Limit Upper Limit Use the intervals to compare the two funds. 75%% of the returns for the balanced fund fall within a narrower range than those of the stock fund. 75% of the returns for the stock fund fall within a narrower range than those of the balanced fund. 25% of the returns for the balanced fund fall within a narrower range than those of the stock fund. 25% of the returns for the stock fund fall within a wider range than those of the balanced fund. (d) Compute the coefficient of variation for each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts