Question: The capital asset pricing model ( CAPM ) explains how risk should be considered when stocks and other assets are held . The CAPM states

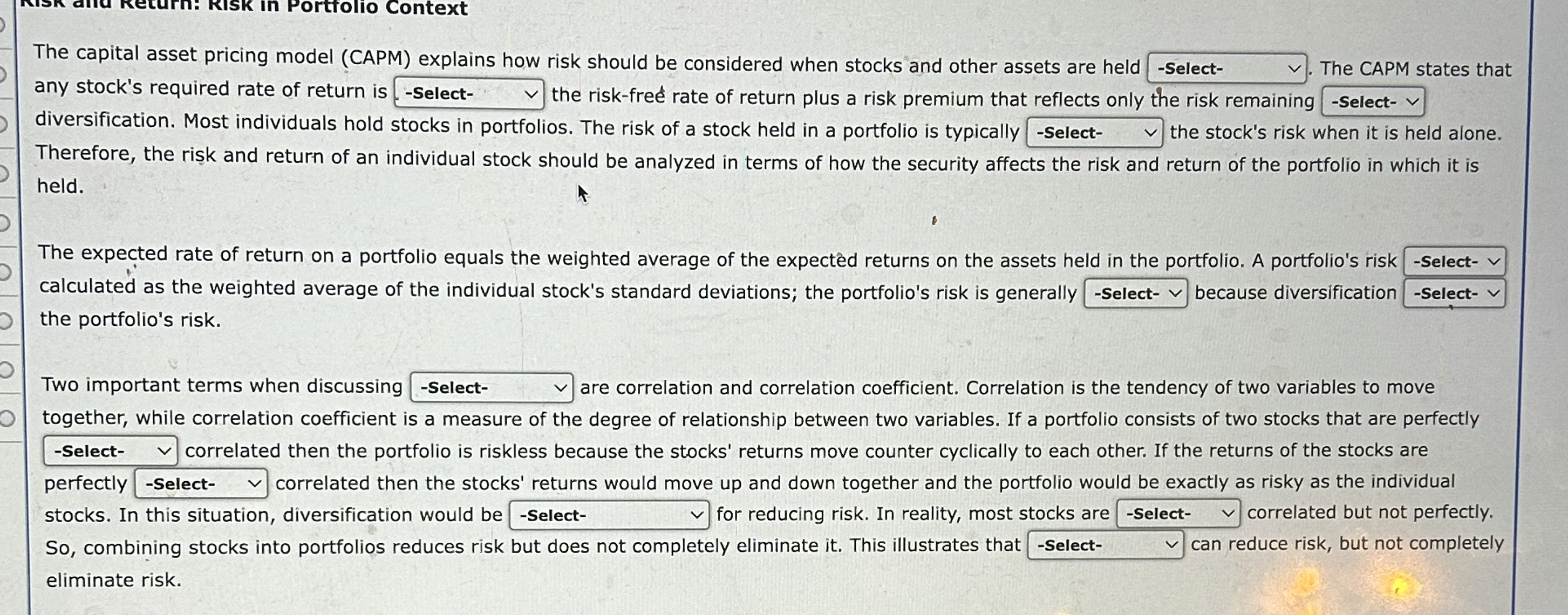

The capital asset pricing model CAPM explains how risk should be considered when stocks and other assets are held

The CAPM states that

any stock's required rate of return is

the riskfree rate of return plus a risk premium that reflects only the risk remaining

diversification. Most individuals hold stocks in portfolios. The risk of a stock held in a portfolio is typically

the stock's risk when it is held alone.

Therefore, the risk and return of an individual stock should be analyzed in terms of how the security affects the risk and return of the portfolio in which it is

held.

The expected rate of return on a portfolio equals the weighted average of the expected returns on the assets held in the portfolio. A portfolio's risk

calculated as the weighted average of the individual stock's standard deviations; the portfolio's risk is generally

because diversification

the portfolio's risk.

Two important terms when discussing

are correlation and correlation coefficient. Correlation is the tendency of two variables to move

together, while correlation coefficient is a measure of the degree of relationship between two variables. If a portfolio consists of two stocks that are perfectly

correlated then the portfolio is riskless because the stocks' returns move counter cyclically to each other. If the returns of the stocks are

perfectly

correlated then the stocks' returns would move up and down together and the portfolio would be exactly as risky as the individual

stocks. In this situation, diversification would be

for reducing risk. In reality, most stocks are

correlated but not perfectly.

So combining stocks into portfolios reduces risk but does not completely eliminate it This illustrates that

can reduce risk, but not completely

eliminate risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock