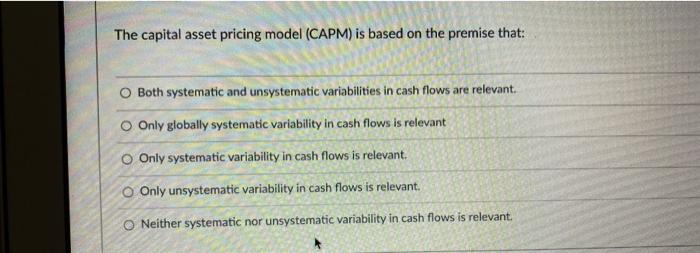

Question: The capital asset pricing model (CAPM) is based on the premise that: Both systematic and unsystematic variabilities in cash flows are relevant. Only globally systematic

The capital asset pricing model (CAPM) is based on the premise that: Both systematic and unsystematic variabilities in cash flows are relevant. Only globally systematic variability in cash flows is relevant Only systematic variability in cash flows is relevant. Only unsystematic variability in cash flows is relevant. Neither systematic nor unsystematic variability in cash flows is relevant. The capital asset pricing model (CAPM) is based on the premise that: Both systematic and unsystematic variabilities in cash flows are relevant. Only globally systematic variability in cash flows is relevant Only systematic variability in cash flows is relevant. Only unsystematic variability in cash flows is relevant. Neither systematic nor unsystematic variability in cash flows is relevant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts