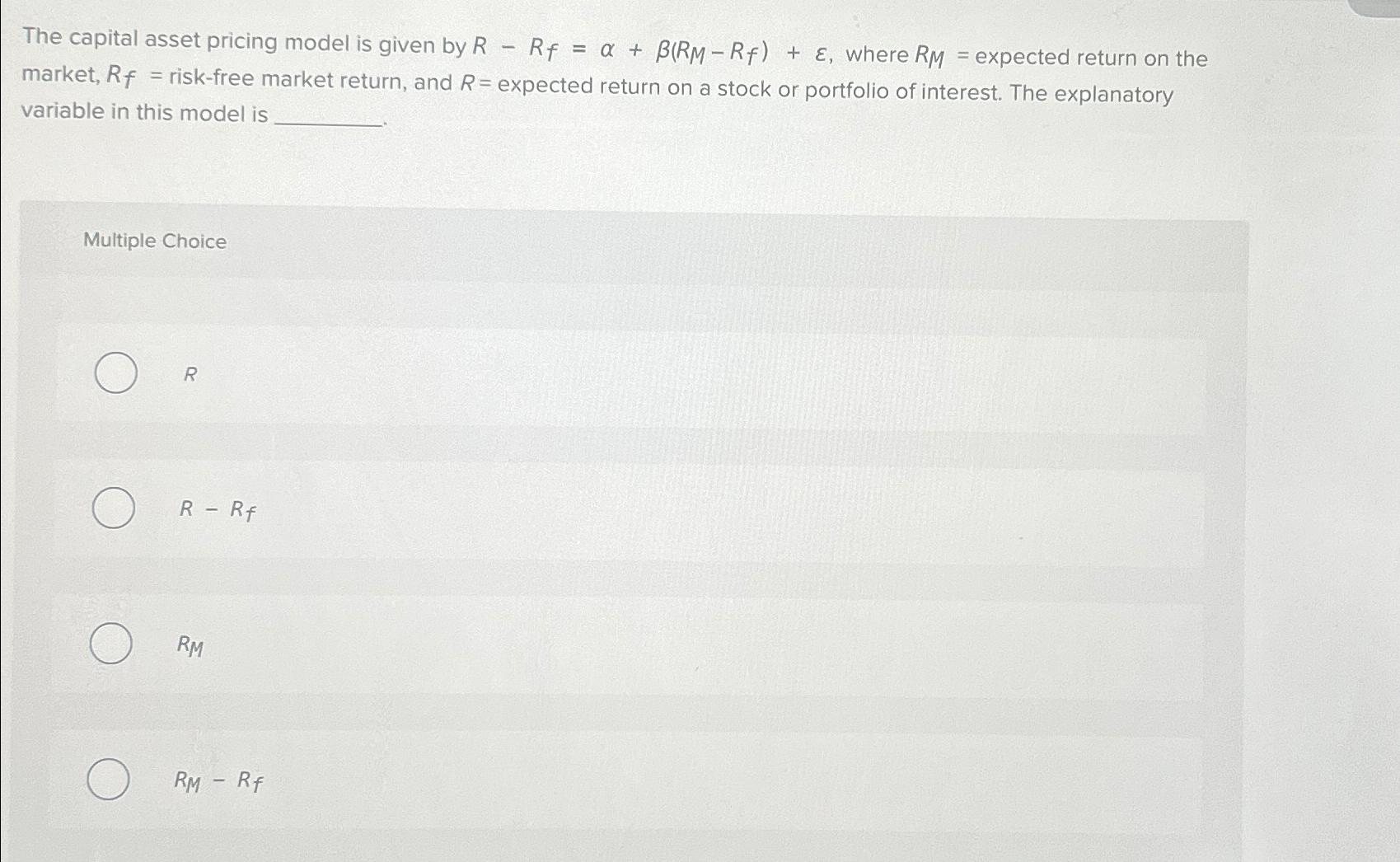

Question: The capital asset pricing model is given by R-R_(f)=alpha +beta (R_(M)-R_(f))+epsi , where R_(M)= expected return on the market, R_(f)= risk-free market return, and R=

The capital asset pricing model is given by

R-R_(f)=\\\\alpha +\\\\beta (R_(M)-R_(f))+\\\\epsi , where

R_(M)=expected return on the market,

R_(f)=risk-free market return, and

R=expected return on a stock or portfolio of interest. The explanatory variable in this model is\ Multiple Choice\

R\

R-R_(f)\

R_(M)\

R_(M)-R_(f)

The capital asset pricing model is given by RRf=+(RMRf)+, where RM= expected return on the market, Rf= risk-free market return, and R= expected return on a stock or portfolio of interest. The explanatory variable in this model is Multiple Choice R RRf RM RMRf

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts