Question: The capital budgeting process is comprehensive and is based on certain assumptions, models, and benchmarks. This process often begins with a project analysis. Generally, the

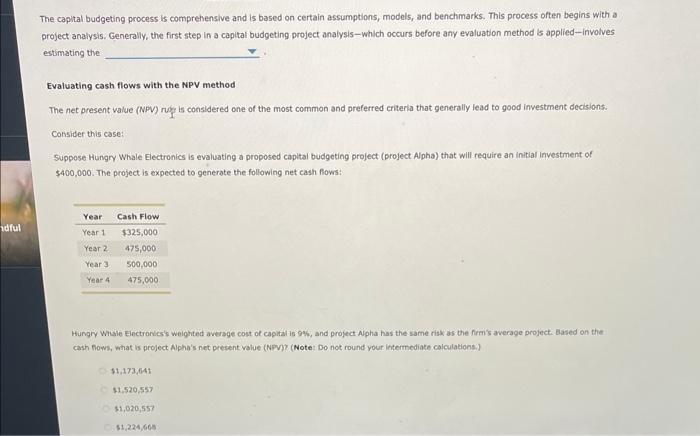

The capital budgeting process is comprehensive and is based on certain assumptions, models, and benchmarks. This process often begins with a project analysis. Generally, the first step in a capital budgeting project analysis-which occurs before any evaluation method is applied-involves estimating the Evaluating cash flows with the NPV method The net present value (NPV) ruge is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Hungry Whale Electronics is evaluating a proposed capital budgeting project (project Alpha) that will require an initlal investment of $400,000. The project is expected to generate the following net cash fows: Hungry Whale Electronics's welghted averoge cost of capital is 9\%, and project Apha has the same risk as the firmis awerage project. Based on the cash frows, what is project Alpha's net present volue (NPV)? (Note: Do not round your intermediate calculations.) 81,173,64181,520,55781,020,55781,224,665

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts