Question: The capital structure is such as, the target weights are wstd = 4%, wd = 20%, wps = 2% and ws = 74%. Whereas std

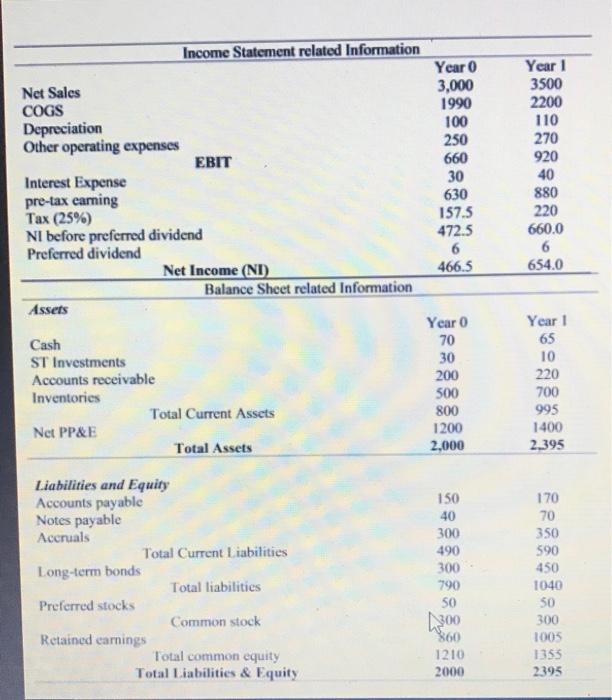

Income Statement related Information Net Sales COGS Depreciation Other operating expenses EBIT Interest Expense pre-tax eaming Tax (25%) NI before preferred dividend Preferred dividend Net Income (NI) Balance Sheet related Information Assets Year 0 3,000 1990 100 250 660 30 630 157.5 472.5 6 466.5 Year 1 3500 2200 110 270 920 40 880 220 660.0 6 654.0 Year 1 65 Cash ST Investments Accounts receivable Inventories Total Current Assets Net PP&E Total Assets Year 0 70 30 200 500 800 1200 2.000 10 220 700 995 1400 2.395 Liabilities and Equity Accounts payable Notes payable Accruals Total Current Liabilities Long-term bonds Total liabilities Preferred stocks Common stock Retained earnings Total common equity Total Liabilities & Equity 150 40 300 490 300 790 50 170 70 350 590 450 1040 50 300 1005 1355 2395 1300 1210 2000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts