Question: The capital structure weights used in computing the weighted average cost of capital: Select one: a. are computed using the book value of the long-term

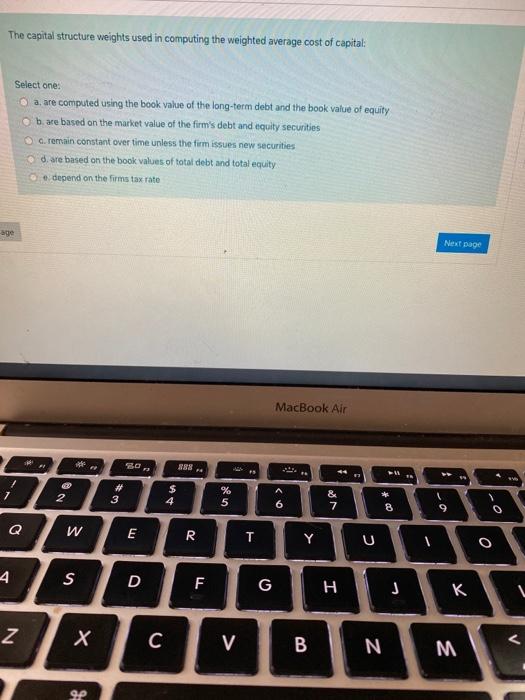

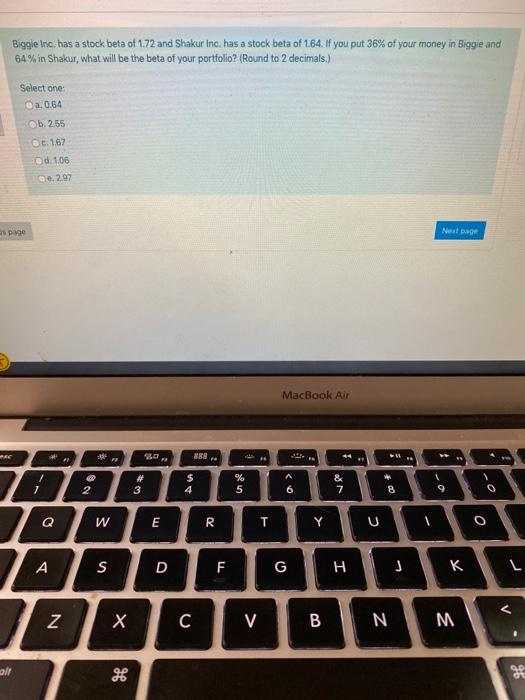

The capital structure weights used in computing the weighted average cost of capital: Select one: a. are computed using the book value of the long-term debt and the book value of equity e bare based on the market value of the firm's debt and equity securities c. remain constant over time unless the firm issues new securities d. are based on the book values of total debt and total equity depend on the firms tax rate Next page MacBook Air BO 288 44 2 $ 4 % 5 & 7 a 8 9 Q W E R R T Y U o 4 S D F H J N V B N. M 90 Biggle Inc. has a stock beta of 172 and Shakur Inc. has a stock beta of 1.64. If you put 36% of your money in Biggie and 64% in Shakur, what will be the beta of your portfolio? (Round to 2 decimals.) Select one: Oa0.64 b.2.55 De 167 d. 106 297 Next page MacBook Air 888 8 - A NO # 3 $ 4 % 5 6 & 7 8 9 0 Q E R T Y U 1 o S D F G .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts