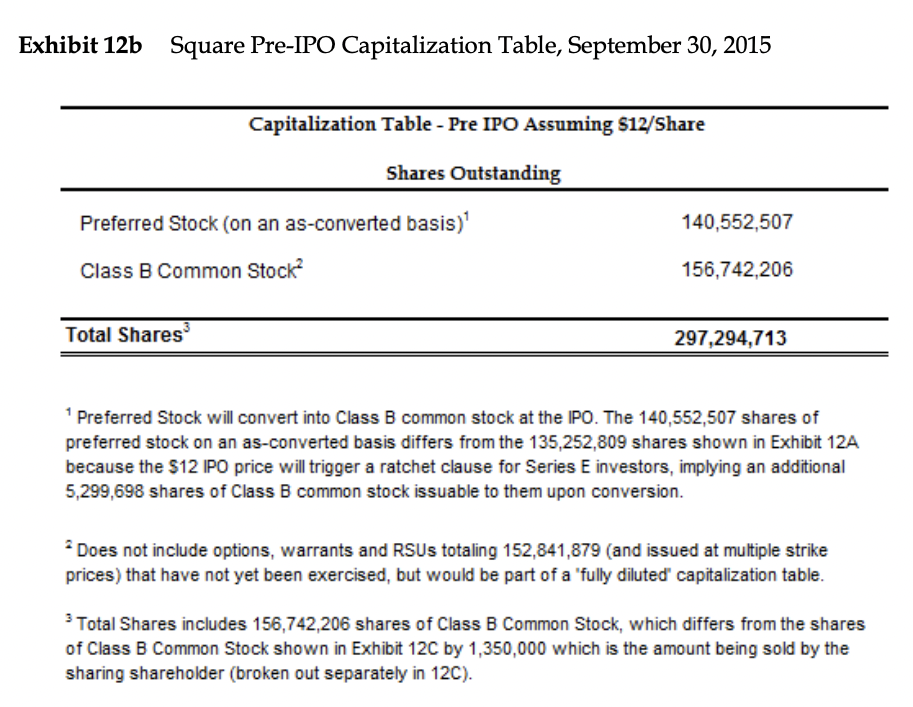

Question: The capitalization table in Exhibit 12b in the case is based on the assumption that IPO price is $12/share. Calculate the number of Preferred stock

The capitalization table in Exhibit 12b in the case is based on the assumption that IPO price is $12/share. Calculate the number of Preferred stock (on an as-converted basis) assuming the IPO price is $9/share. What is the number of total shares (assume Class B Common Stock stays the same)?

Exhibit 12b Square Pre-IPO Capitalization Table, September 30, 2015 Capitalization Table - Pre IPO Assuming $12/Share Shares Outstanding Preferred Stock (on an as-converted basis) 140,552,507 Class B Common Stock 156,742,206 Total Shares 297,294,713 Preferred Stock will convert into Class B common stock at the IPO. The 140,552,507 shares of preferred stock on an as-converted basis differs from the 135,252,809 shares shown in Exhibit 12A because the $12 IPO price will trigger a ratchet clause for Series E investors, implying an additional 5,299,698 shares of Class B common stock issuable to them upon conversion. * Does not include options, warrants and RSUS totaling 152,841,879 (and issued at multiple strike prices) that have not yet been exercised, but would be part of a "fully diluted" capitalization table. Total Shares includes 156,742,206 shares of Class B Common Stock, which differs from the shares of Class B Common Stock shown in Exhibit 12C by 1,350,000 which is the amount being sold by the sharing shareholder (broken out separately in 12C). Exhibit 12b Square Pre-IPO Capitalization Table, September 30, 2015 Capitalization Table - Pre IPO Assuming $12/Share Shares Outstanding Preferred Stock (on an as-converted basis) 140,552,507 Class B Common Stock 156,742,206 Total Shares 297,294,713 Preferred Stock will convert into Class B common stock at the IPO. The 140,552,507 shares of preferred stock on an as-converted basis differs from the 135,252,809 shares shown in Exhibit 12A because the $12 IPO price will trigger a ratchet clause for Series E investors, implying an additional 5,299,698 shares of Class B common stock issuable to them upon conversion. * Does not include options, warrants and RSUS totaling 152,841,879 (and issued at multiple strike prices) that have not yet been exercised, but would be part of a "fully diluted" capitalization table. Total Shares includes 156,742,206 shares of Class B Common Stock, which differs from the shares of Class B Common Stock shown in Exhibit 12C by 1,350,000 which is the amount being sold by the sharing shareholder (broken out separately in 12C)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts