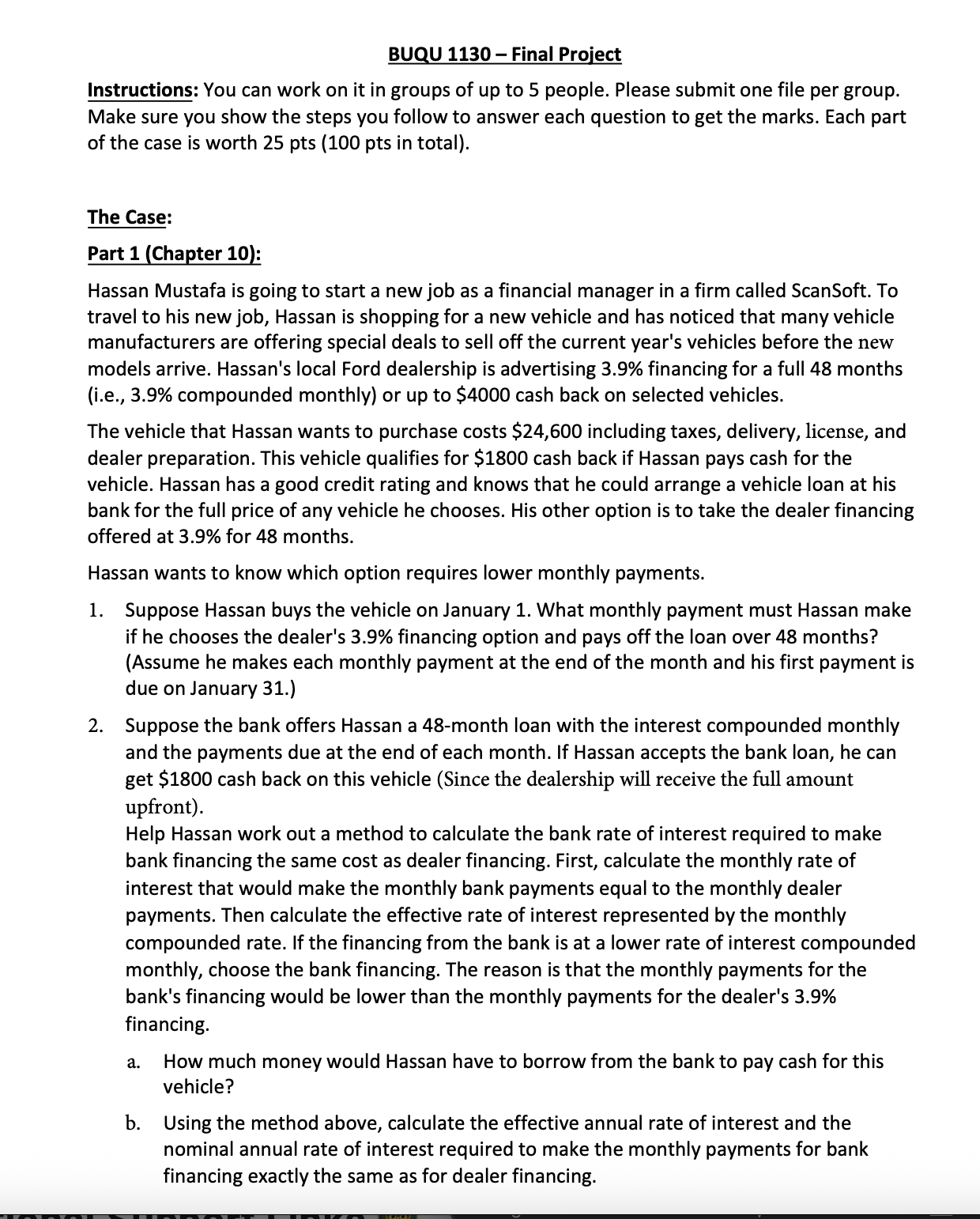

Question: The Case: Part 1 ( Chapter 1 0 : Hassan Mustafa is going to start a new job as a financial manager in a firm

The Case:

Part Chapter :

Hassan Mustafa is going to start a new job as a financial manager in a firm called ScanSoft. To

travel to his new job, Hassan is shopping for a new vehicle and has noticed that many vehicle

manufacturers are offering special deals to sell off the current year's vehicles before the new

models arrive. Hassan's local Ford dealership is advertising financing for a full months

ie compounded monthly or up to $ cash back on selected vehicles.

The vehicle that Hassan wants to purchase costs $ including taxes, delivery, license, and

dealer preparation. This vehicle qualifies for $ cash back if Hassan pays cash for the

vehicle. Hassan has a good credit rating and knows that he could arrange a vehicle loan at his

bank for the full price of any vehicle he chooses. His other option is to take the dealer financing

offered at for months.

Hassan wants to know which option requires lower monthly payments.

Suppose Hassan buys the vehicle on January What monthly payment must Hassan make

if he chooses the dealer's financing option and pays off the loan over months?

Assume he makes each monthly payment at the end of the month and his first payment is

due on January

Suppose the bank offers Hassan a month loan with the interest compounded monthly

and the payments due at the end of each month. If Hassan accepts the bank loan, he can

get $ cash back on this vehicle Since the dealership will receive the full amount

upfront

Help Hassan work out a method to calculate the bank rate of interest required to make

bank financing the same cost as dealer financing. First, calculate the monthly rate of

interest that would make the monthly bank payments equal to the monthly dealer

payments. Then calculate the effective rate of interest represented by the monthly

compounded rate. If the financing from the bank is at a lower rate of interest compounded

monthly, choose the bank financing. The reason is that the monthly payments for the

bank's financing would be lower than the monthly payments for the dealer's

financing.

a How much money would Hassan have to borrow from the bank to pay cash for this

vehicle?

b Using the method above, calculate the effective annual rate of interest and the

nominal annual rate of interest required to make the monthly payments for bank

financing exactly the same as for dealer financing.

Suppose Hassan decides to explore the costs of financing a more expensive vehicle. The

more expensive vehicle costs $ in total and qualifies for the dealer financing for

months or $ cash back, if Hassan pays the dealership in cash. What is the highest

effective annual rate of interest at which Hassan should borrow

Part Chapter :

Hassan and Dana had bought a property valued at $ for down and a mortgage

amortized over years on March They made equal endofmonth payments towards

their mortgage. Interest on the mortgage was compounded semiannually and the

mortg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock