Question: The cash budget is considered the primary forecasting tool when firms try to estimate their cash flows and figure out if they are likely to

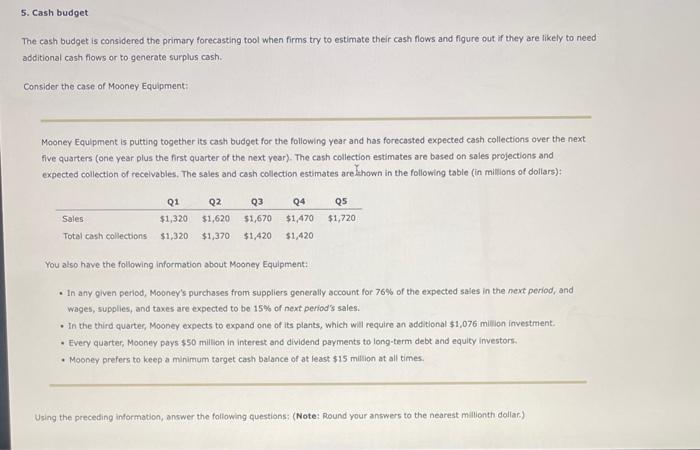

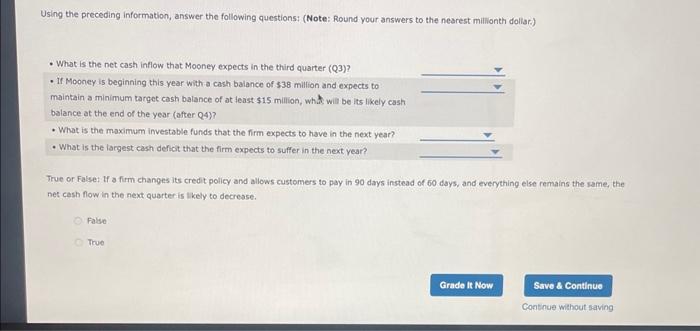

The cash budget is considered the primary forecasting tool when firms try to estimate their cash flows and figure out if they are likely to need additional cash flows or to generate surplus cash. Consider the case of Mooney Equipment: Mooney Equlpment is putting together its cash budget for the following year and has forecasted expected cash collections over the next five quarters (one year plus the first quarter of the next year). The cash collection estimates are based on sales projections and expected collection of recelvables. The sales and cash collection estimates are thown in the following table (in millions of dollars): You also have the following information about Mooney Equipment: - In any given period, Mooney's purchases from suppliers generally account for 76% of the expected sales in the nevt period, and wages, supplies, and toxes are expected to be 15% of next period's sales. - In the third quarter, Mooney expects to expand one of its plants, which wall require an additional $1,076 million investment. - Every quarter, Mooney pays $50 million in interest and dividend payments to long-term debt and equity investors. - Mooney prefers to keep a minimum target cash balance of at least $15 million at all times. Using the preceding information, answer the following questions: (Note: Round your answers to the nearest millionth dollar.) Using the preceding information, answer the following questions: (Note: Round your answers to the nearest millionth dollar.) True or False: If a firm changes its credit policy and allows customers to pay in 90 days instead of 60 days, and everything else remains the same, the net cash flow in the next quarter is Ikely to decrease. False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts