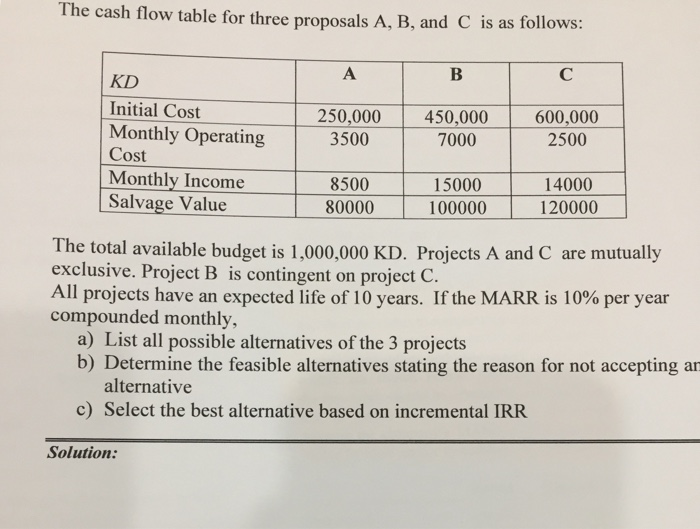

Question: The cash flow table for three proposals A, B, and C is as fol KD Initial Cost Monthly Operating Cost Monthly Income Salvage Value 250,000

The cash flow table for three proposals A, B, and C is as fol KD Initial Cost Monthly Operating Cost Monthly Income Salvage Value 250,000 450,000 600,000 3500 2500 14000 100000120000 7000 8500 80000 15000 The total available budget is 1,000,000 KD. Projects A and C are mutually exclusive. Project B is contingent on project C. All projects have an expected life of 10 years. If the MARR is 10% per year compounded monthly, a) List all possible alternatives of the 3 projects b) Determine the feasible alternatives stating the reason for not accepting ar alternative c) Select the best alternative based on incremental IRR Solution: The cash flow table for three proposals A, B, and C is as fol KD Initial Cost Monthly Operating Cost Monthly Income Salvage Value 250,000 450,000 600,000 3500 2500 14000 100000120000 7000 8500 80000 15000 The total available budget is 1,000,000 KD. Projects A and C are mutually exclusive. Project B is contingent on project C. All projects have an expected life of 10 years. If the MARR is 10% per year compounded monthly, a) List all possible alternatives of the 3 projects b) Determine the feasible alternatives stating the reason for not accepting ar alternative c) Select the best alternative based on incremental IRR Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts