Question: The cash flows for a project are as follows: Initial Outlay: $65939 Year 1: $38,000 Year 2: $10,000 Year 3: $20,000 Year 4: $38155 Year

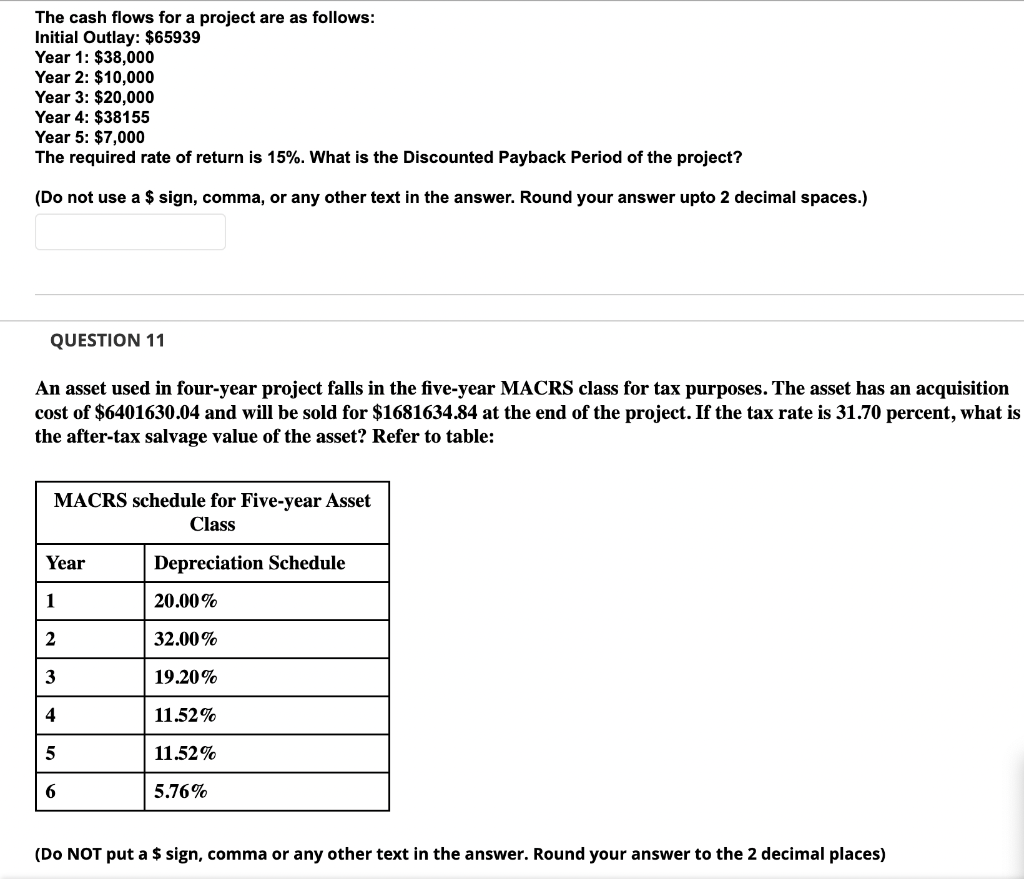

The cash flows for a project are as follows: Initial Outlay: $65939 Year 1: $38,000 Year 2: $10,000 Year 3: $20,000 Year 4: $38155 Year 5: $7,000 The required rate of return is 15%. What is the Discounted Payback Period of the project? (Do not use a \$ sign, comma, or any other text in the answer. Round your answer upto 2 decimal spaces.) QUESTION 11 An asset used in four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6401630.04 and will be sold for $1681634.84 at the end of the project. If the tax rate is 31.70 percent, what is the after-tax salvage value of the asset? Refer to table: (Do NOT put a \$ sign, comma or any other text in the answer. Round your answer to the 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts