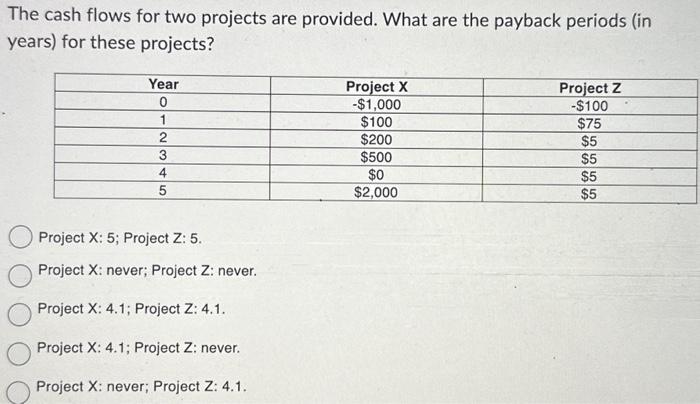

Question: The cash flows for two projects are provided. What are the payback periods (in years) for these projects? Project X: 5; Project Z: 5 .

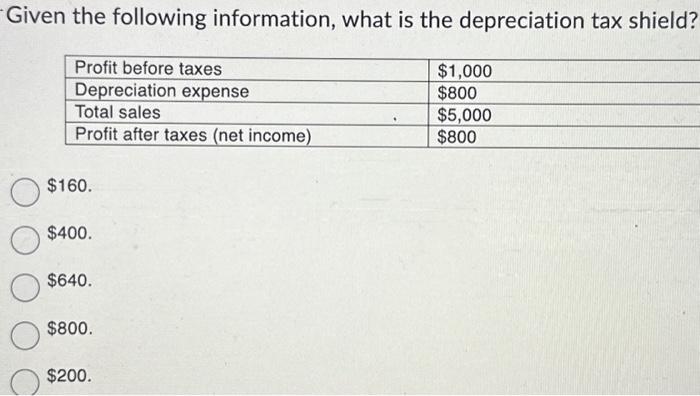

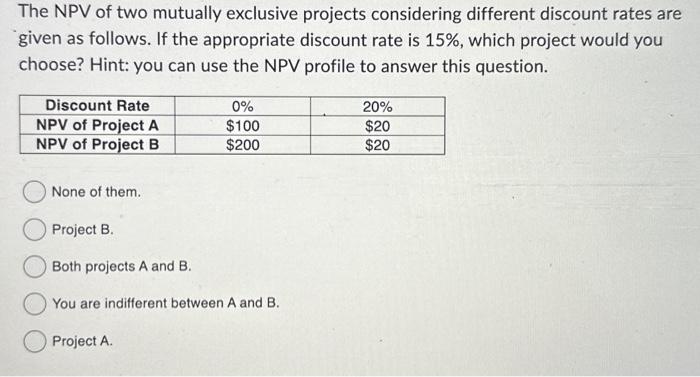

The cash flows for two projects are provided. What are the payback periods (in years) for these projects? Project X: 5; Project Z: 5 . Project X : never; Project Z : never. Project X:4.1; Project Z: 4.1. Project X:4.1; Project Z : never. Project X : never; Project Z:4.1. Given the following information, what is the depreciation tax shield? $160. $400. $640. $800. $200. The NPV of two mutually exclusive projects considering different discount rates are given as follows. If the appropriate discount rate is 15%, which project would you choose? Hint: you can use the NPV profile to answer this question. None of them. Project B. Both projects A and B. You are indifferent between A and B. Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts