Question: The cashflow for Project M are as given. Year Project M a. Calculate the payback period (PP), the discounted payback period (DPP), the net present

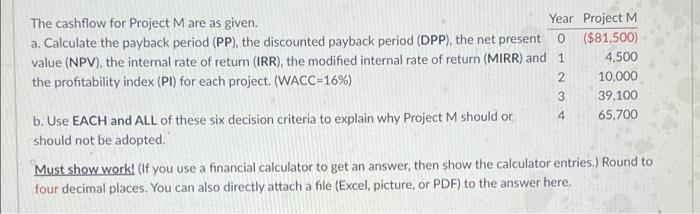

The cashflow for Project M are as given. Year Project M a. Calculate the payback period (PP), the discounted payback period (DPP), the net present o ($81,500) value (NPV), the internal rate of return (IRR), the modified internal rate of return (MIRR) and 1 4,500 the profitability index (Pl) for each project. (WACC=16%) 2 10,000 3 39.100 b. Use EACH and ALL of these six decision criteria to explain why Project M should or 65,700 should not be adopted. Must show work! (If you use a financial calculator to get an answer, then show the calculator entries.) Round to four decimal places. You can also directly attach a file (Excel, picture, or PDF) to the answer here. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts