Question: The CDE Plc's dividends per share are expected to grow indefinitely by 2% per year. Part A). CDE just paid a dividend of 2 per

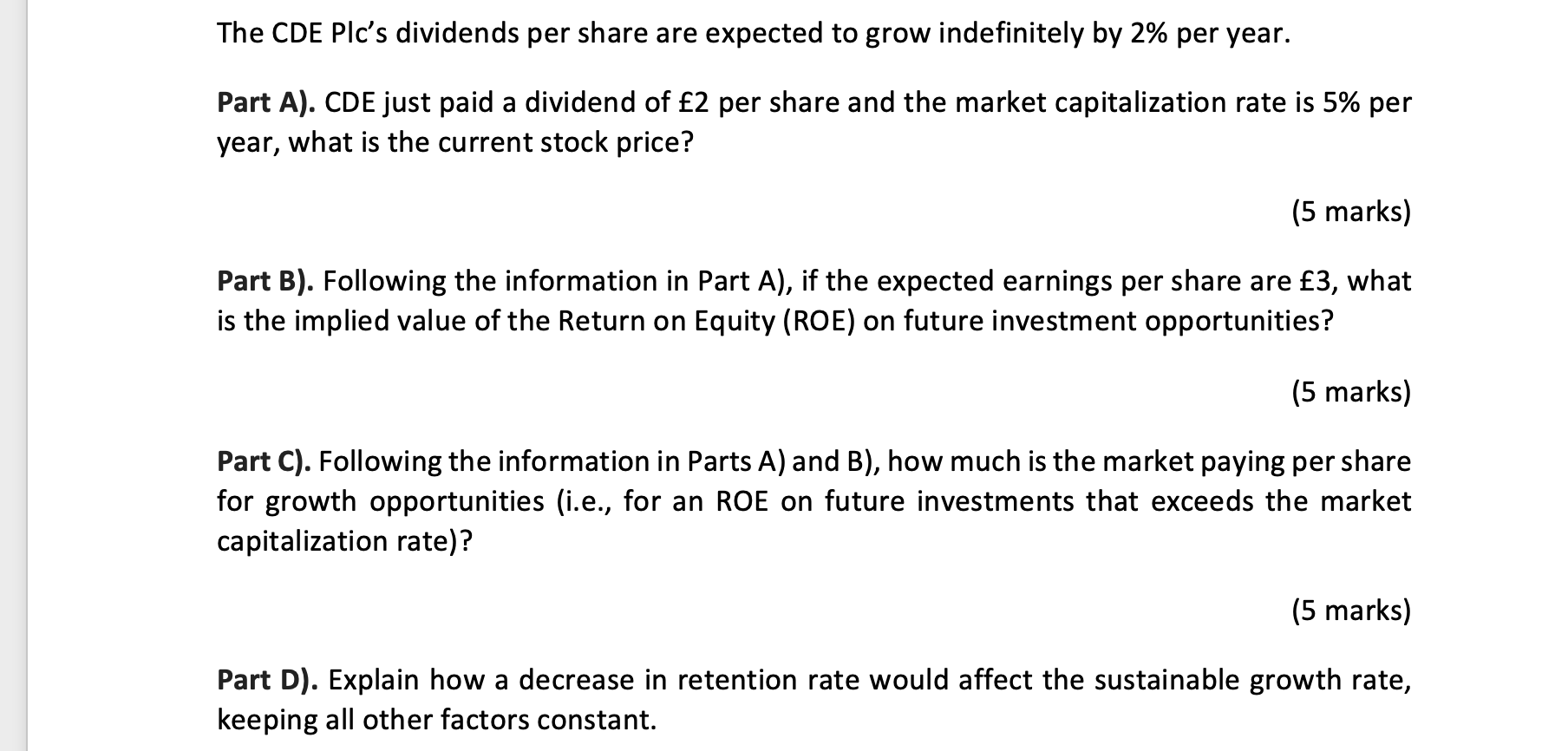

The CDE Plc's dividends per share are expected to grow indefinitely by 2% per year. Part A). CDE just paid a dividend of 2 per share and the market capitalization rate is 5% per year, what is the current stock price? (5 marks) Part B). Following the information in Part A), if the expected earnings per share are 3, what is the implied value of the Return on Equity (ROE) on future investment opportunities? (5 marks) Part C). Following the information in Parts A) and B), how much is the market paying per share for growth opportunities (i.e., for an ROE on future investments that exceeds the market capitalization rate)? (5 marks) Part D). Explain how a decrease in retention rate would affect the sustainable growth rate, keeping all other factors constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts