Question: The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit eamed by the

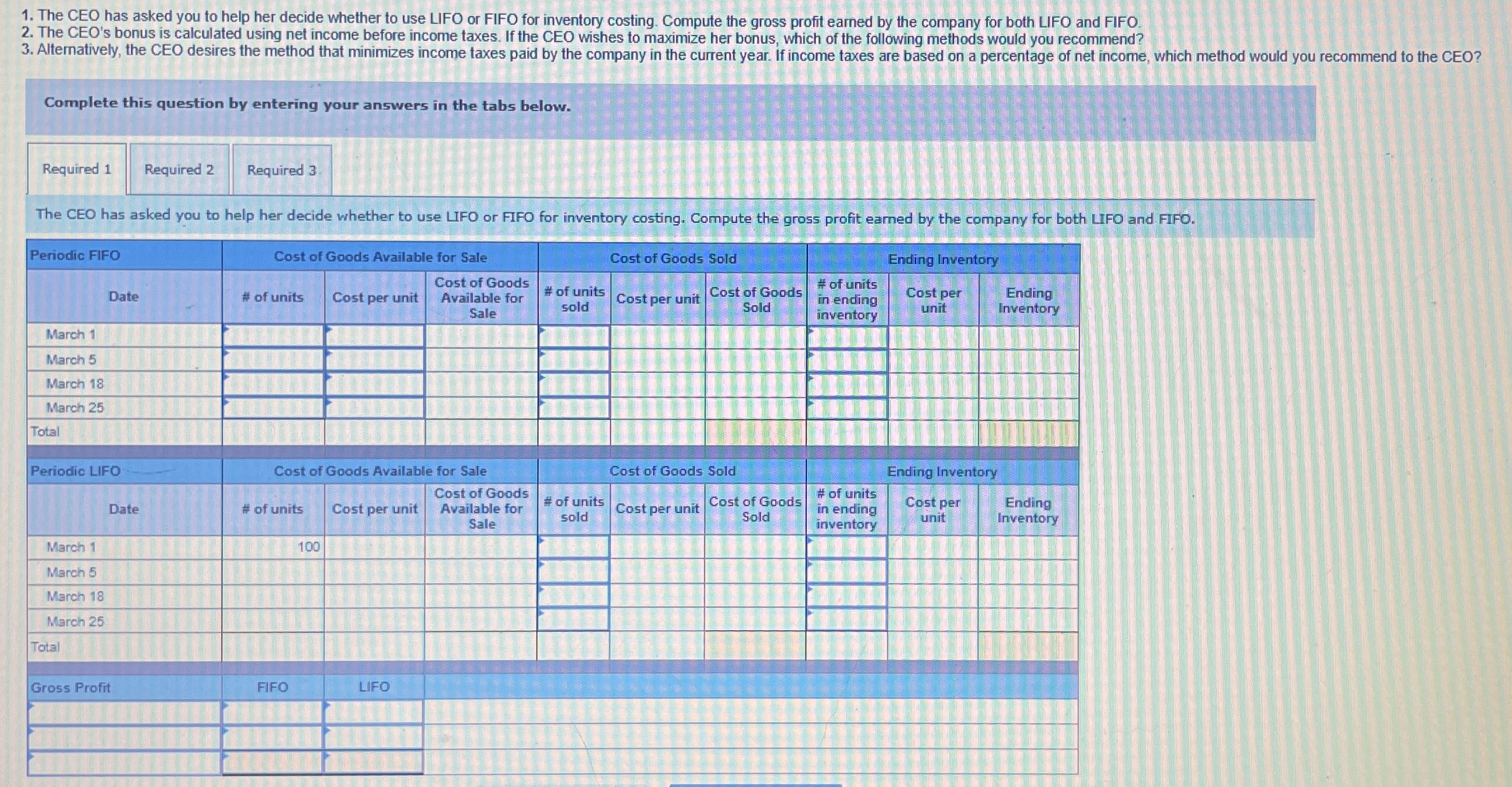

The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit eamed by the company for both LIFO and FIFO.

The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend?

Complete this question by entering your answers in the tabs below.

Required

Required

The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit eamed by the company for both LIFO and FIFO.

tablePeriodic FIFO,Cost of Goods Available for Sale,Cost of Goods Sold,Ending InventoryDate# of units,Cost per unit,tableCost of GoodsAvailable forSaletable# of unitssoldCost per unit,tableCost of GoodsSoldtable# of unitsin endinginventorytableCost perunittableEndingInventoryMarch Til,TMarch Wis,March tableMarch ETotalDIPeriodic LIFO,Cost of Goods Available for Sale,Cost of Goods Sold,Ending InventoryDate# of units,Cost per unit,tableCost of GoodsAvailable forSaletable# of unitssoldCost per unit,tableCost of GoodsSoldtable# of unitsin endinginventorytableCost perunittableEndingInventoryMarch ind,,,,URE,March March March TotalGross Profit,FIFO,LIFO,,,,,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock