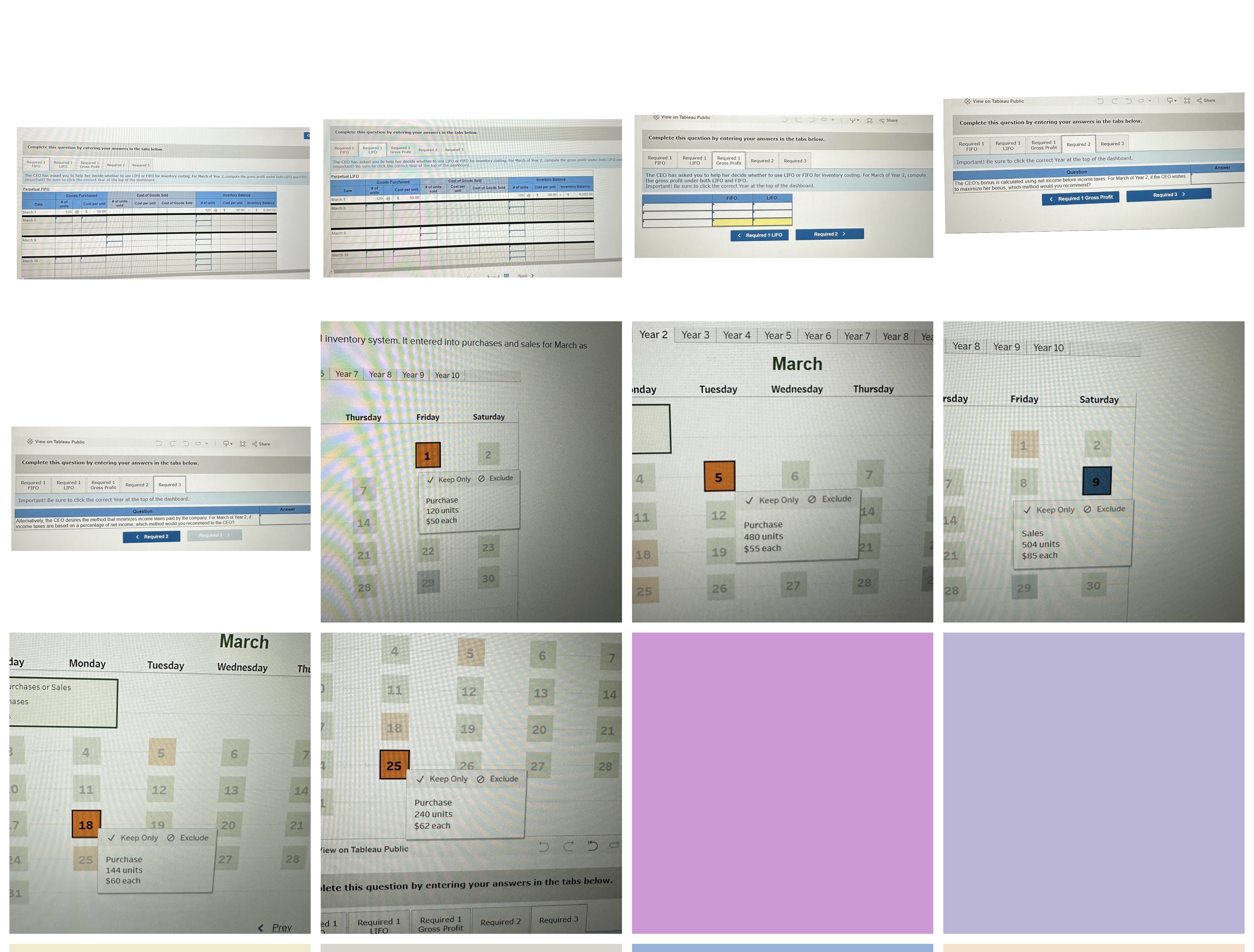

Question: The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. For March of Year 2 , compute

The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. For March of Year compute the gross profit under both LIFO and FIFO.Important! Be sure to click the correct Year at the top of the dashboard.The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. For March of Year compute the gross profit under both LIFO and FIFO.Important! Be sure to click the correct Year at the top of the dashboard.The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. For March of Year compute the gross profit under both LIFO and FIFO.Important! Be sure to click the correct Year at the top of the dashboard.The CEO's bonus is calculated using net income before income taxes. For March of Year if the CEO wishes to maximize her bonus, which method would you recommend?Alternatively, the CEO desires the method that minimizes income taxes paid by the company. For March of Year if income taxes are based on a percentage of net income, which method would you recommend to the CEO?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock