Question: The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what

The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF 1.5 million, a one-year period, an initial spot rate of SF1.5000/$, a 4.533% cost of debt, and a 30% tax rate, what is the effective after-tax cost of debt for one year for a U.S. dollar-based company if the exchange rate at the end of the period was: a. SF1.5000/$ b. SF1.4600/$ c. SF1.3840/$ d. SF1.5920/$

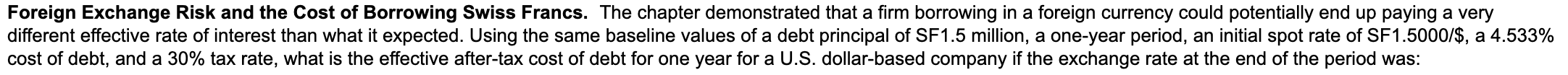

Foreign Exchange Risk and the Cost of Borrowing Swiss Francs. The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF1.5 million, a one-year period, an initial spot rate of SF1.5000/$, a 4.533% cost of debt, and a 30% tax rate, what is the effective after-tax cost of debt for one year for a U.S. dollar-based company if the exchange rate at the end of the period was: a. SF1.5000/$ b. SF1.4600/$ c. SF1.3840/$ d. SF1.5920/$ a. If the exchange rate at the end of the period was SF1.5000/$, what is the effective after-tax cost of debt? % (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts