Question: The Chum Bucket is considering developing and distributing a new type of Krabby patty to drive its competitor, The Krusty Krab, out of business. The

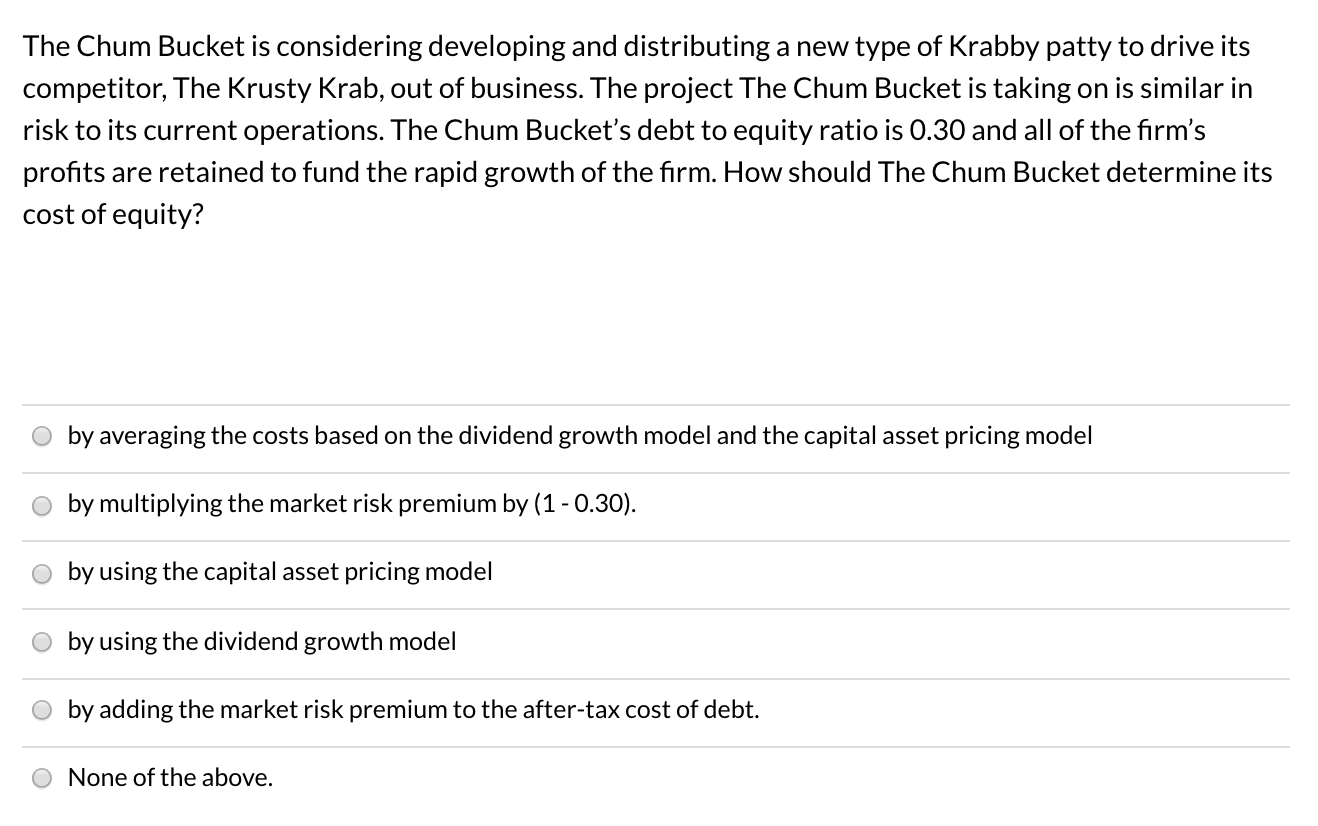

The Chum Bucket is considering developing and distributing a new type of Krabby patty to drive its competitor, The Krusty Krab, out of business. The project The Chum Bucket is taking on is similar in risk to its current operations. The Chum Bucket's debt to equity ratio is 0.30 and all of the firm's profits are retained to fund the rapid growth of the firm. How should The Chum Bucket determine its cost of equity? O by averaging the costs based on the dividend growth model and the capital asset pricing model o by multiplying the market risk premium by (1 -0.30). o by using the capital asset pricing model O by using the dividend growth model O by adding the market risk premium to the after-tax cost of debt. O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts