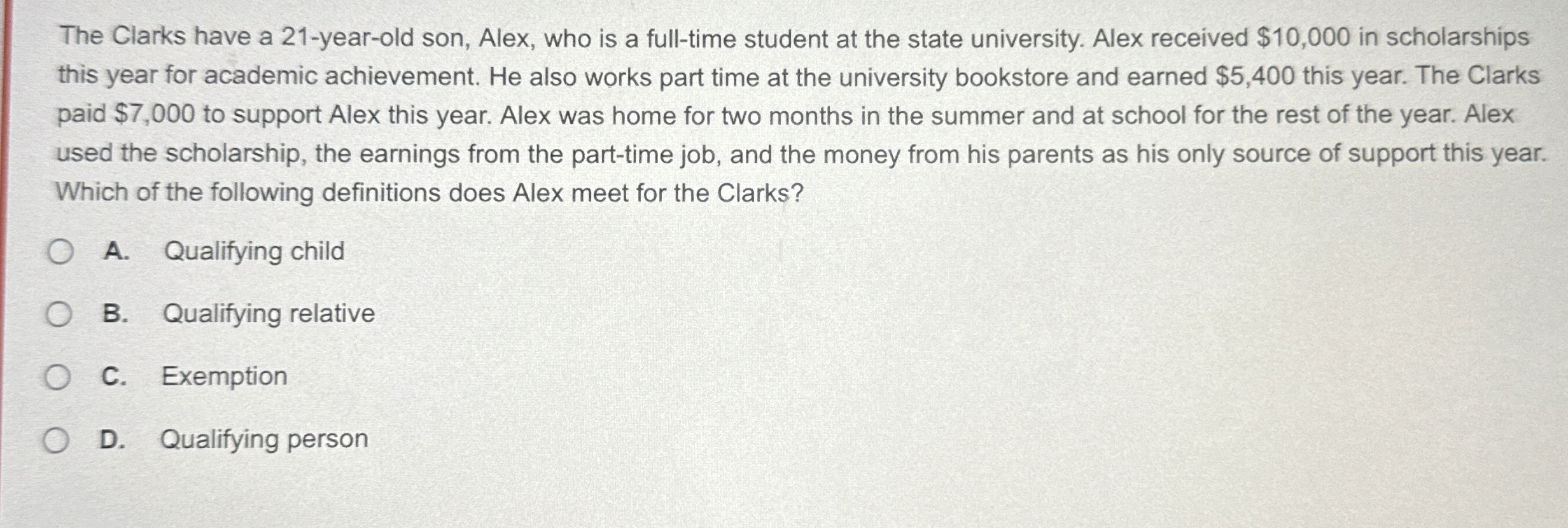

Question: The Clarks have a 2 1 - year - old son, Alex, who is a full - time student at the state university. Alex received

The Clarks have a yearold son, Alex, who is a fulltime student at the state university. Alex received $ in scholarships

this year for academic achievement. He also works part time at the university bookstore and earned $ this year. The Clarks

paid $ to support Alex this year. Alex was home for two months in the summer and at school for the rest of the year. Alex

used the scholarship, the earnings from the parttime job, and the money from his parents as his only source of support this year.

Which of the following definitions does Alex meet for the Clarks?

A Qualifying child

B Qualifying relative

C Exemption

D Qualifying person

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock