Question: The Click to Select options are: Plain vanilla, or MLGIC A friend tells you he is interested in a market-linked GIC (MLGIC) offered by Canadian

The Click to Select options are: Plain vanilla, or MLGIC

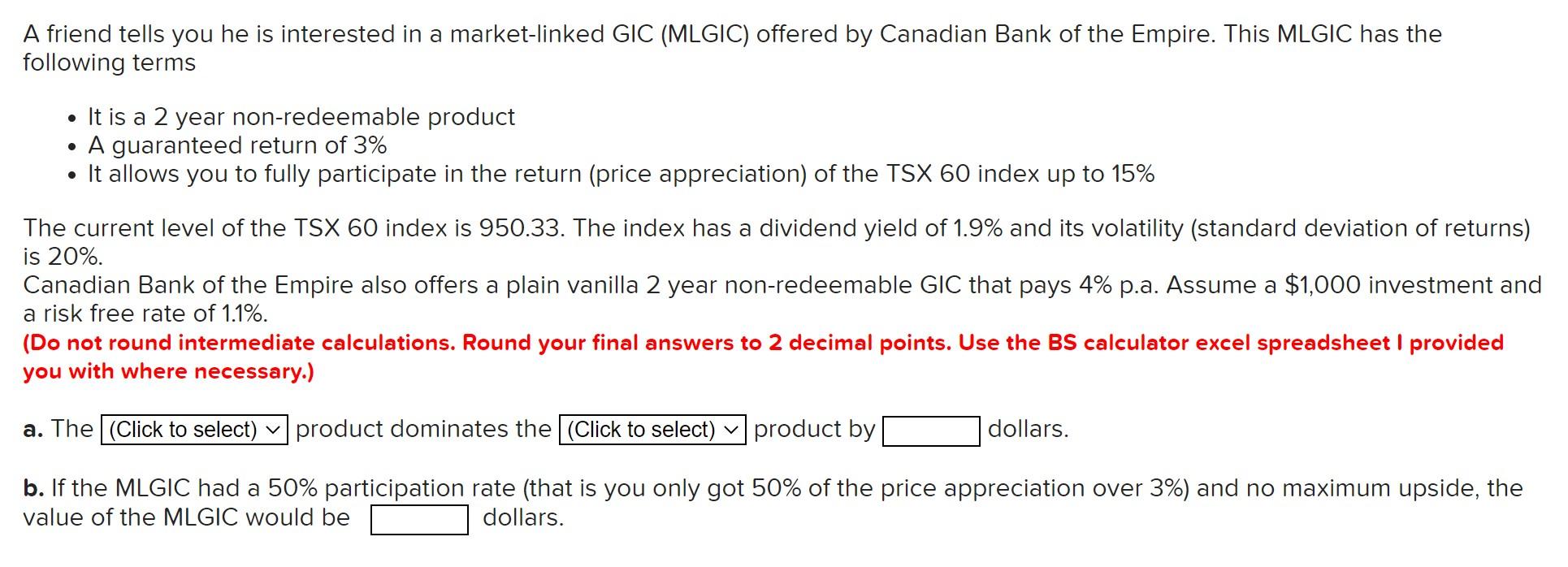

A friend tells you he is interested in a market-linked GIC (MLGIC) offered by Canadian Bank of the Empire. This MLGIC has the following terms It is a 2 year non-redeemable product A guaranteed return of 3% It allows you to fully participate in the return (price appreciation) of the TSX 60 index up to 15% The current level of the TSX 60 index is 950.33. The index has a dividend yield of 1.9% and its volatility (standard deviation of returns) is 20%. Canadian Bank of the Empire also offers a plain vanilla 2 year non-redeemable GIC that pays 4% p.a. Assume a $1,000 investment and a risk free rate of 1.1%. (Do not round intermediate calculations. Round your final answers to 2 decimal points. Use the BS calculator excel spreadsheet I provided you with where necessary.) a. The (Click to select) v product dominates the (Click to select) v product by dollars. b. If the MLGIC had a 50% participation rate (that is you only got 50% of the price appreciation over 3%) and no maximum upside, the value of the MLGIC would be dollars. A friend tells you he is interested in a market-linked GIC (MLGIC) offered by Canadian Bank of the Empire. This MLGIC has the following terms It is a 2 year non-redeemable product A guaranteed return of 3% It allows you to fully participate in the return (price appreciation) of the TSX 60 index up to 15% The current level of the TSX 60 index is 950.33. The index has a dividend yield of 1.9% and its volatility (standard deviation of returns) is 20%. Canadian Bank of the Empire also offers a plain vanilla 2 year non-redeemable GIC that pays 4% p.a. Assume a $1,000 investment and a risk free rate of 1.1%. (Do not round intermediate calculations. Round your final answers to 2 decimal points. Use the BS calculator excel spreadsheet I provided you with where necessary.) a. The (Click to select) v product dominates the (Click to select) v product by dollars. b. If the MLGIC had a 50% participation rate (that is you only got 50% of the price appreciation over 3%) and no maximum upside, the value of the MLGIC would be dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts