Question: The CML versus the SML a. You hold an efficient portfolio. Which of the CML or the SML gives you the expected return on your

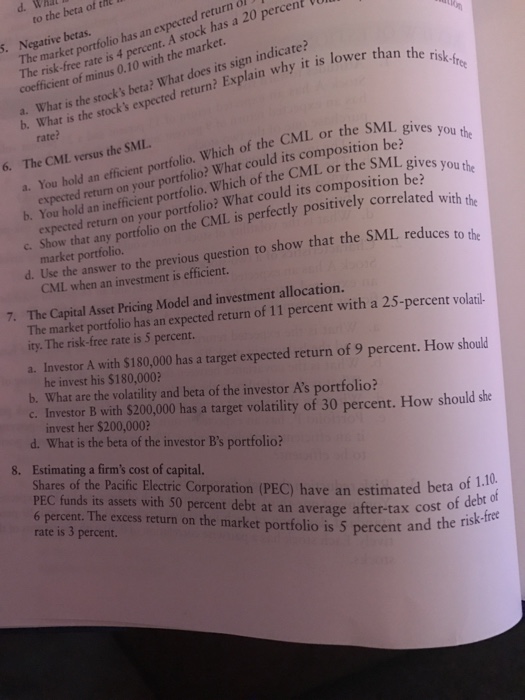

The CML versus the SML a. You hold an efficient portfolio. Which of the CML or the SML gives you the expected return on your portfolio? What could its composition be? b. You hold an inefficient portfolio. Which of the CML or the SML gives you the expected return on your portfolio? What could its composition be? c. Show that any portfolio on the CML is perfectly positively correlated with the market portfolio d. Use the answer to the previous question to show that the SML reduces to the CML when an investment is efficient. The Capital Asset Pricing Model and investment allocation. The market has an expected return of 11 percent with a 25 - percent volatility. The risk free rate is 5 percent. a. Investor a with $180,000 has a target expected return of 9 percent. How should he invest his $180,000? b. What are the volatility and beta of the investor A's portfolio? c. Investor B with $200,000 has a target volatility of 30 percent. How should she invest her $200,000? d. What is the beta of the investor B's portfolio? Estimating a firm's cost of capital. Shares of the Pacific Electric Corporation (PEC) have an estimated beta of 1.10 PEC funds its assets with 50 percent debt at an average after tax cost of debt of 6 percent. The excess return on the market portfolio is 5 percent and the risk free rate is 3 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts