Question: The Code of Professional Conduct emphasizes a CPA's need to act ethically when carrying out his/her duties as a CPA. Given the following situation, comprehensively

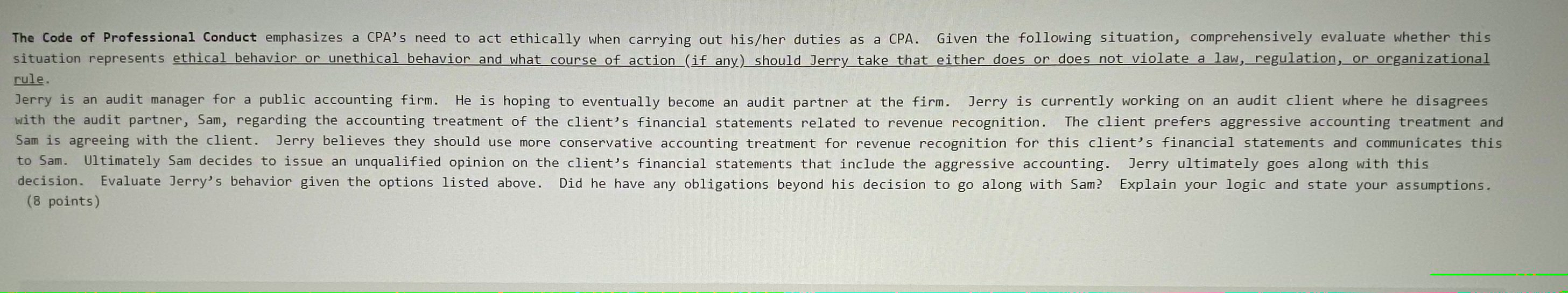

The Code of Professional Conduct emphasizes a CPA's need to act ethically when carrying out his/her duties as a CPA. Given the following situation, comprehensively evaluate whether this situation represents ethical behavior or unethical behavior and what course of action (if any) should Jerry take that either does or does not violate a law, regulation, or organizational rule. Jerry is an audit manager for a public accounting firm. He is hoping to eventually become an audit partner at the firm. Jerry is currently working on an audit client where he disagrees with the audit partner, Sam, regarding the accounting treatment of the client's financial statements related to revenue recognition. The client prefers aggressive accounting treatment and Sam is agreeing with the client. Jerry believes they should use more conservative accounting treatment for revenue recognition for this client's financial statements and communicates this to Sam. Ultimately Sam decides to issue an unqualified opinion on the client's financial statements that include the aggressive accounting. Jerry ultimately goes along with this decision. Evaluate Jerry's behavior given the options listed above. Did he have any obligations beyond his decision to go along with Sam? Explain your logic and state your assumptions. (8 points) The Code of Professional Conduct emphasizes a CPA's need to act ethically when carrying out his/her duties as a CPA. Given the following situation, comprehensively evaluate whether this situation represents ethical behavior or unethical behavior and what course of action (if any) should Jerry take that either does or does not violate a law, regulation, or organizational rule. Jerry is an audit manager for a public accounting firm. He is hoping to eventually become an audit partner at the firm. Jerry is currently working on an audit client where he disagrees with the audit partner, Sam, regarding the accounting treatment of the client's financial statements related to revenue recognition. The client prefers aggressive accounting treatment and Sam is agreeing with the client. Jerry believes they should use more conservative accounting treatment for revenue recognition for this client's financial statements and communicates this to Sam. Ultimately Sam decides to issue an unqualified opinion on the client's financial statements that include the aggressive accounting. Jerry ultimately goes along with this decision. Evaluate Jerry's behavior given the options listed above. Did he have any obligations beyond his decision to go along with Sam? Explain your logic and state your assumptions. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts