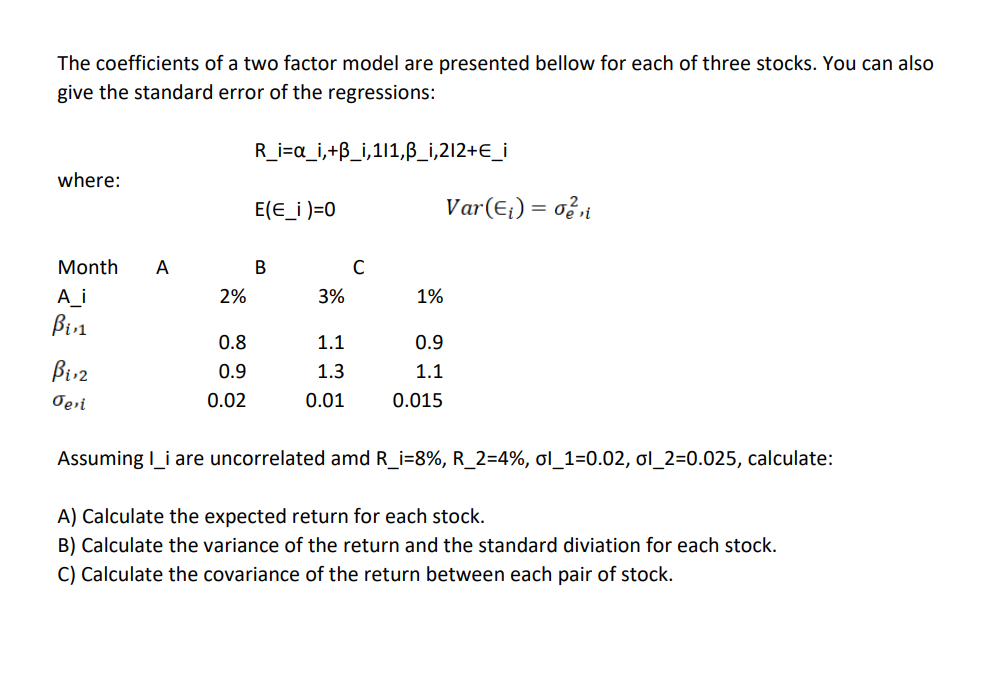

Question: The coefficients of a two factor model are presented bellow for each of three stocks. You can also give the standard error of the regressions:

The coefficients of a two factor model are presented bellow for each of three stocks. You can also give the standard error of the regressions: Ri=i,+_i,11,i,212+_i where: E(i)=0Var(i)=e2,i Assuming I_i are uncorrelated amd R_i=8%,R_2=4%,_1=0.02,_2=0.025, calculate: A) Calculate the expected return for each stock. B) Calculate the variance of the return and the standard diviation for each stock. C) Calculate the covariance of the return between each pair of stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock