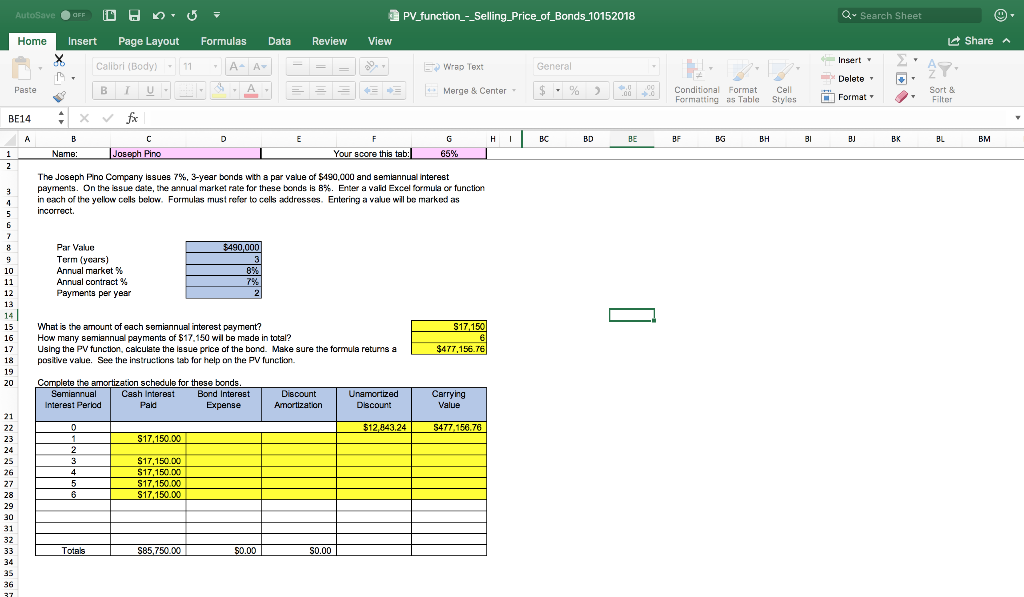

Question: The Company issues 7%, 3-year bonds with a par value of $490,000 and semiannual interest payments. On the issue date, the annual market rate for

The Company issues 7%, 3-year bonds with a par value of $490,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value will be marked as incorrect. |

AutoSave OFF DH = PV_function_-_Selling Price_of_Bonds_10152018 Q Search Sheet Home Insert Page Layout Formulas Data Review View Share X Insert Calibri (Body) - 11 A A Wrap Text General Delete - Paste B 1 Merge & Center $ - % ,00 Conditional Format Formatting as Table Cell Styles Format Sort & Filter BE14 X A - fx C Joseph Pino B D E H BC BD BE BF BG BH 31 BL BM G 65% 1 Name: Your score this tab: 2 The Joseph Pino Company issues 7%, 3-year bonds with a par value of $190,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value wil be marked as incorrect 3 4 5 6 7 8 Par Value Term (years) Annual market % Annual contract % Payments per year $490,000 3 8% 7% 2 10 11 12 13 14 15 16 17 18 19 20 What is the amount of each semiannual interest payment? How many semiannual payments of $17.150 wil be made in total? Using the PV function, calculate the issue price of the bond. Make sure the formula returns a positive value. See the instructions tab for help on the PV function $17,150 6 $477.156.76 Complete the amortization schedule for these bonds. Semiannual Cash Interest Bond Interest Interest Period Pald Expense Discount Amortization Unamortized Discount Carrying Value 0 $12,843.24 S477.156.76 $17,150.00 1 2 3 4 5 6 $17,150.00 $17,150.00 $17,150.00 $17,150.00 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Totals $85,750.00 $0.00 S0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts