Question: The comparative balance sheets for 2 0 2 4 and 2 0 2 3 and the statement of income for 2 0 2 4 are

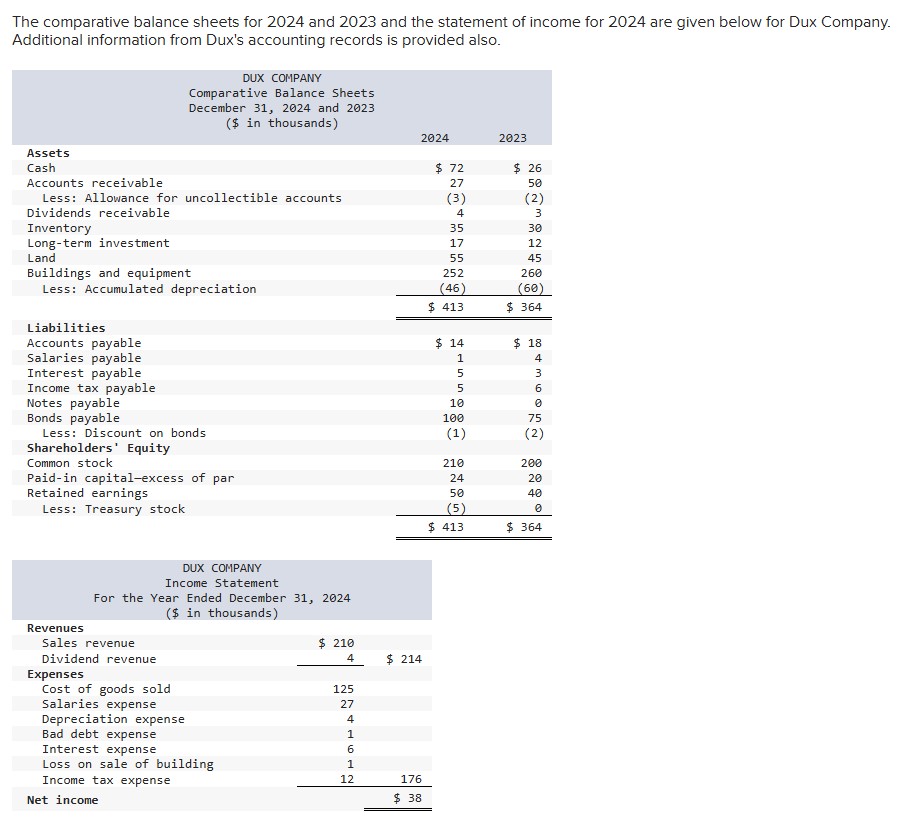

The comparative balance sheets for and and the statement of income for are given below for Dux Company. Additional information from Dux's accounting records is provided also.

DUX COMPANYComparative Balance SheetsDecember and $ in thousandsAssetsCash$ $ Accounts receivableLess: Allowance for uncollectible accountsDividends receivableInventoryLongterm investmentLandBuildings and equipmentLess: Accumulated depreciation$ $ LiabilitiesAccounts payable$ $ Salaries payableInterest payableIncome tax payableNotes payableBonds payableLess: Discount on bondsShareholders EquityCommon stockPaidin capitalexcess of parRetained earningsLess: Treasury stock$ $

DUX COMPANYIncome StatementFor the Year Ended December $ in thousandsRevenuesSales revenue$ Dividend revenue$ ExpensesCost of goods soldSalaries expenseDepreciation expenseBad debt expenseInterest expenseLoss on sale of buildingIncome tax expenseNet income$

Additional information from the accounting records:

A building that originally cost $ and which was threefourths depreciated, was sold for $

The common stock of Byrd Corporation was purchased for $ as a longterm investment.

Property was acquired by issuing a sevenyear, $ note payable to the seller.

New equipment was purchased for $ cash.

On January bonds were sold at their $ face value.

On January Dux issued a stock dividend shares The market price of the $ par value common stock was $ per share at that time.

Cash dividends of $ were paid to shareholders.

On November shares of common stock were repurchased as treasury stock at a cost of $

Required:

Prepare the statement of cash flows of Dux Company for the year ended December Present cash flows from operating activities by the direct method.

The comparative balance sheets for and and the statement of income for are given below for Dux Company. Additional information from Dux's accounting records is provided also. Additional information from the accounting records:

a A building that originally cost $ and which was threefourths depreciated, was sold for $

b The common stock of Byrd Corporation was purchased for $ as a longterm investment.

c Property was acquired by issuing a sevenyear, $ note payable to the seller.

d New equipment was purchased for $ cash.

e On January bonds were sold at their $ face value.

f On January Dux issued a stock dividend shares The market price of the $ par value common stock was $ per share at that time.

g Cash dividends of $ were paid to shareholders.

h On November shares of common stock were repurchased as treasury stock at a cost of $

Required:

Prepare the statement of cash flows of Dux Company for the year ended December Present cash flows from operating activities by the direct method.

Note: Do not round your intermediate calculations. Enter your answers in thousands ie should be entered as Amounts to be deducted should be indicated with a minus sign. begintabularcc

hline Cash flows from investing activities: &

hline &

hline &

hline &

hline &

hline &

hline Net cash flows from investing activities &

hline Cash flows from financing activities: &

hline &

hline &

hline &

hline &

hline &

hline Net cash flows from financing activities &

hline Net increase decrease in cash &

hline Cash balance, January &

hline Cash balance, December & $

hline Noncash investing and financing activities: &

hline square &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock