Question: The comparative balance sheets for 2018 and 2017 and the statement of Income for 2018 are given below for Wright Company. Additional Information from Wright's

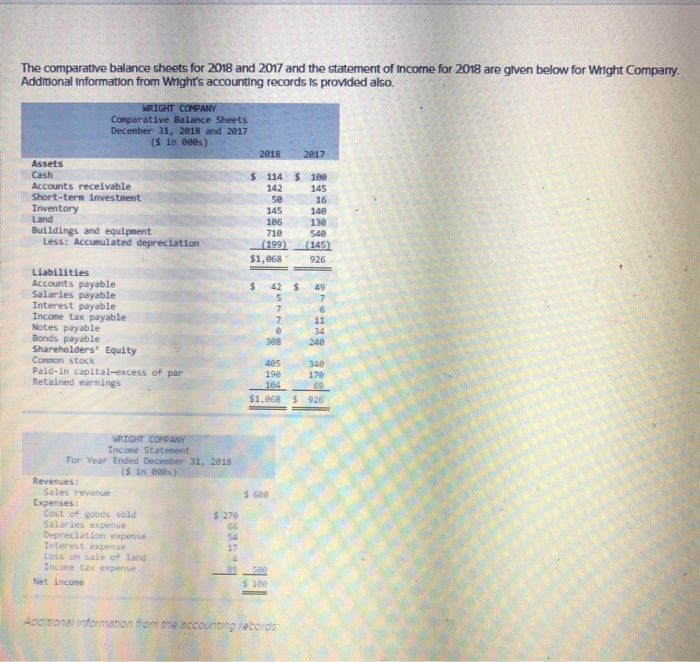

The comparative balance sheets for 2018 and 2017 and the statement of Income for 2018 are given below for Wright Company. Additional Information from Wright's accounting records Is provided also. WRIGHT COMPANY Comparative Balance Sheets Decenber 31, 2018 and 2017 (S in eees) 2018 2017 Assets Cash $ 114 $ 100 142 Accounts receivable Short-term investment Inventory Land Buildings and equipnent Less: Accumulated depreciation 145 16 140 50 145 106 130 710 540 (199) (145) $1,068 926 Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable Shareholders' Equity %24 42 49 7. 34 308 240 Connon stock 405 340 Paid-in capital-excess of par Retained earnings 190 170 104 69 $1,068 $ 926 WRIGHT COMPANY Income Statement For Year Ended Decenber 31, 2018 (S in eees) Revenues: Sales revenue Expenses: Cost of goods sold Salaries expense Depreciation expense Interest expense Loss on sale of land Income tax expense $ 600 $ 270 66 54 17 4. 89 500 $ 100 Net incone Additional information from the accounting records WRIGHT COMPANY Statement of Cash Flows For year ended December 31, 2018 (S in 000s) Cash flows from operating activities: Cash inflows: Cash outflows Net cash flows from operating activities. Cash flows from investing activities: Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities Cash balance, January 1 Cash balance, December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts