Question: The complete question is attached as a screen shot, please refer. 2. Corporate share repurchase programs are often touted as a benet for shareholders. But

The complete question is attached as a screen shot, please refer.

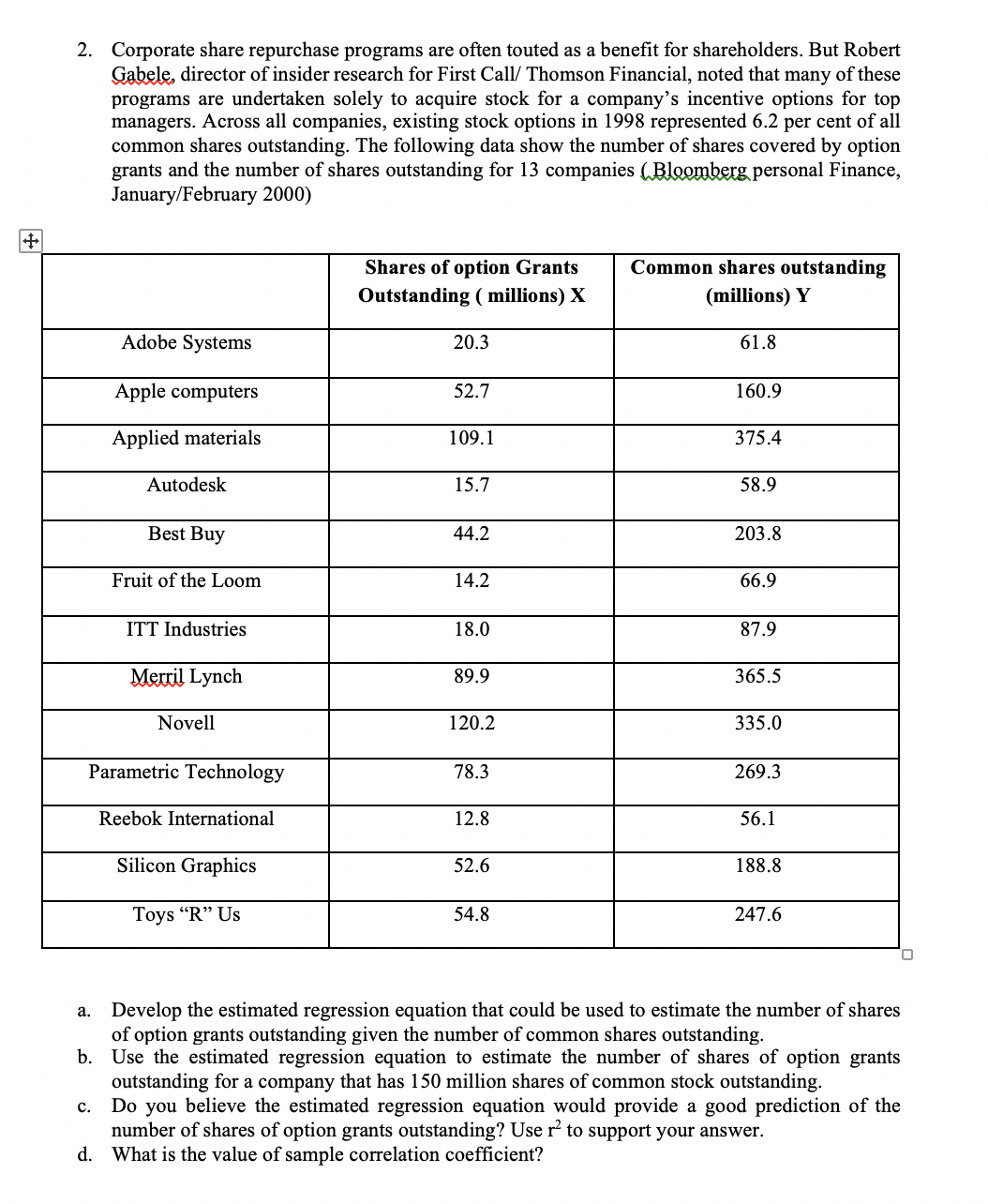

2. Corporate share repurchase programs are often touted as a benet for shareholders. But Robert Qabele, director of insider research for First Call! Thomson Financial, noted that many of these programs are undertaken solely to acquire stock for a company's incentive options for top managers. Across all companies, existing stock options in 1998 represented 6.2 per cent of all common shares outstanding. The following data show the number of shares covered by option grants and the number of shares outstanding for 13 companies Wpersonal Finance, January/February 2000) ___ Outstanding ( millions) X (millions) Y __ __ El a. Develop the estimated regression equation that could be used to estimate the number of shares of option grants Outstanding given the number of common shares outstanding. b. Use the estimated regression equation to estimate the number of shares of option grants outstanding for a company that has 150 million shares of common stock outstanding. c. Do you believe the estimated regression equation would provide a good prediction of the number of shares of option grants outstanding? Use r2 to support your answer. d. What is the value of sample correlation coefcient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts