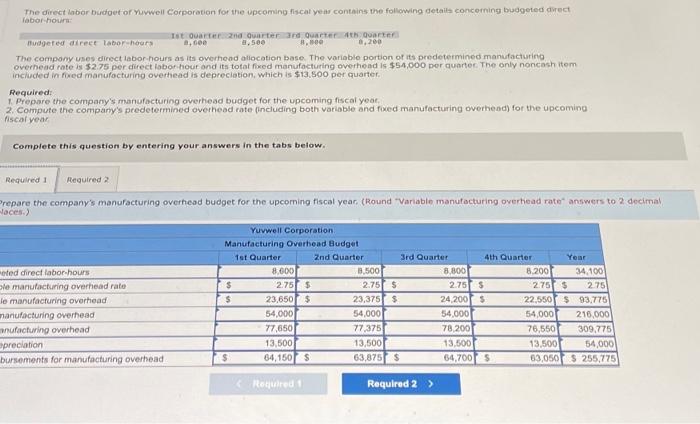

Question: The compony uses direct labor-hours as its overheod allocation base. The variable portion of its predetermined manufacturing overnead rate is $2.75 per direct laborhour ond

The compony uses direct labor-hours as its overheod allocation base. The variable portion of its predetermined manufacturing overnead rate is $2.75 per direct laborhour ond its totat fixed manufocturing overhead is $54,000 per quarter. The only noncash item inciucled in fired manufocturino overthead is depreciation, which is $13.500 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal yeat. hiscalvear Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compute the company's predetermaned overhead rate (including both variable and fixed manufacturing overthead) for the upcorning fiscal year (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts