Question: The concept store you will be pitching is typically free with a large contract. Such contracts typically promise substantial growth over the current business. In

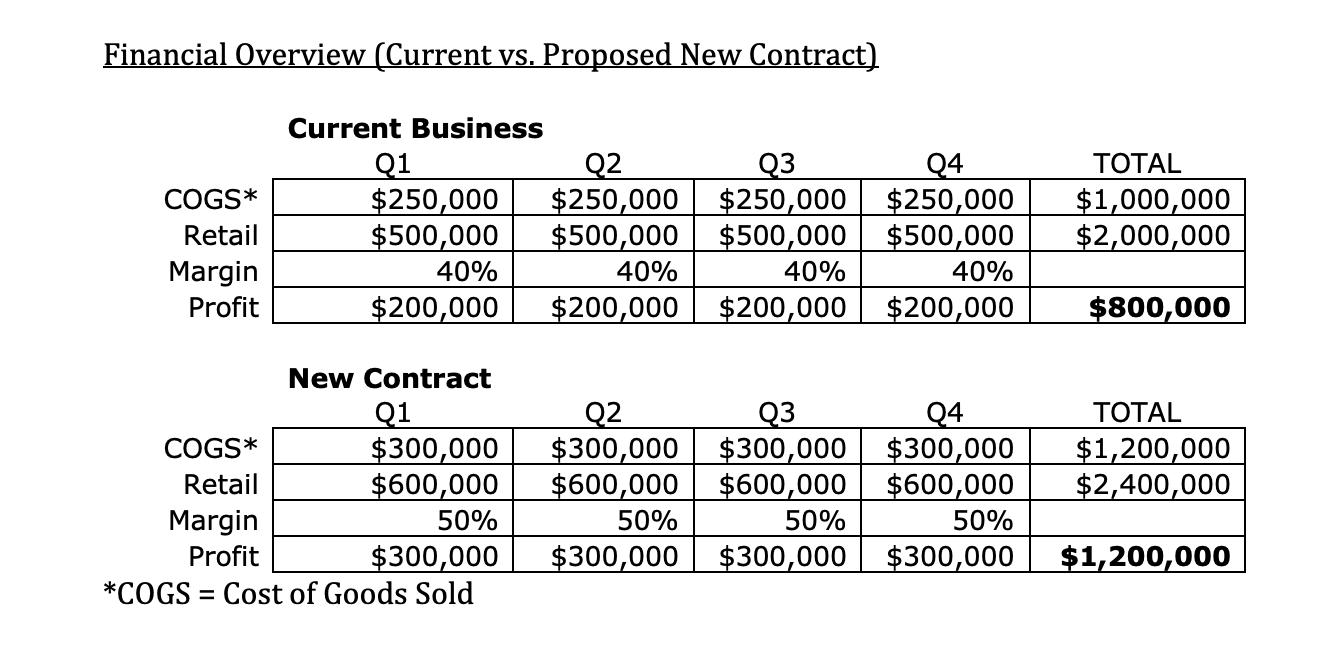

The concept store you will be pitching is typically free with a large contract. Such contracts typically promise substantial growth over the current business. In Bob’s case, he purchases $1,000,000 in product from Nike each year. His margins have suffered a bit due to discounting old unsold products. Typical margins on Nike products are 50%, Bob has been hovering around 40%. Normally, a merchandising build-out like Bob needs would cost Nike $500,000 ($125,000 per store); Nike typically pays for this build-out with a promise of 100% growth year over year for 3 years. Bob cannot sustain that growth, so a Nike-funded merchandising build is out of the question given your currently available budget. Instead, you must convince Bob to pay for his own build-out; the benefit of this to Bob is that he would only have to promise an increase of 20% in product buy from Nike for the next 3 years. This revenue growth is needed to:

1) Pay for the construction crew that would build the fixtures (Nike employees will do the construction and design)

2) Fill the new fixtures with the product (and keep them filled), at current levels the fixtures would be 20% empty on average

3) Deliver multiple shipments each quarter, compared to Bob’s fewer but larger shipments he is now receiving; this ensures proper available sizes and a breadth of color options

Bob will have to consider this financial investment carefully; it is up to you to properly illustrate to him the return on investment he will receive (example: his investment will be paid off in X amount of time and will increase profitability by X amount over the course of the next several years).

Calculate a return on investment (ROI) and payback period for your offer.

To make these calculations, you will have to highlight certain financial criteria:

sales increase

profit margins

investment and return on investment

Financial Overview (Current vs. Proposed New Contract) Current Business Q1 Q2 Q3 Q4 COGS* $250,000 $250,000 $250,000 $250,000 $500,000 $500,000 $500,000 Retail $500,000 Margin 40% 40% 40% 40% Profit $200,000 $200,000 $200,000 $200,000 New Contract Q1 Q2 Q3 Q4 COGS* $300,000 $300,000 $300,000 $300,000 Retail $600,000 $600,000 $600,000 $600,000 50% Margin 50% 50% 50% $300,000 $300,000 $300,000 Profit $300,000 *COGS = Cost of Goods Sold TOTAL $1,000,000 $2,000,000 $800,000 TOTAL $1,200,000 $2,400,000 $1,200,000

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

The return on investment ROI would be 20 and the payback period would be 3 ye... View full answer

Get step-by-step solutions from verified subject matter experts