Question: The Constructo Construction Company is a real estate developer and building contractor. The company has two sources of long-term capital, debt and equity. The cost

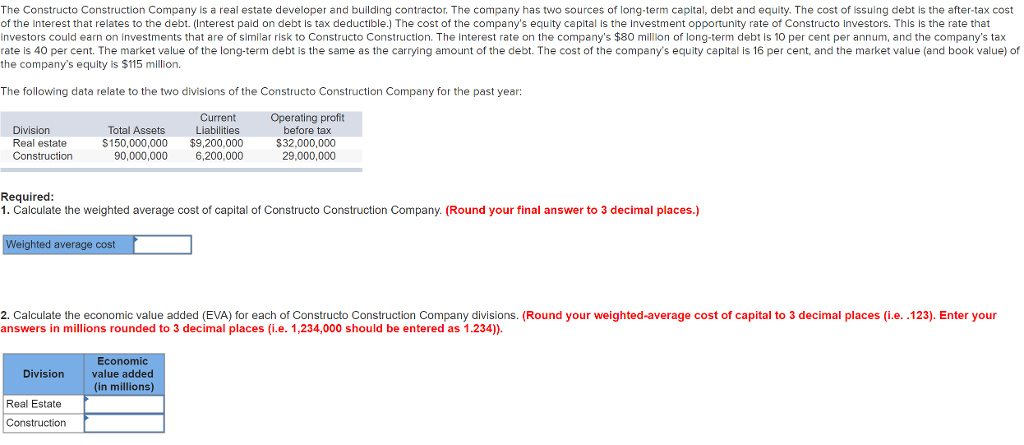

The Constructo Construction Company is a real estate developer and building contractor. The company has two sources of long-term capital, debt and equity. The cost of issuing debt is the after-tax cost of the interest that relates to the debt. (Interest paid on debt is tax deductible.) The cost of the company's equity capital is the investment opportunity rate of Constructo investors. This is the rate that investors could earn on investments that are of similar risk to Constructo Construction. The Interest rate on the company's $80 million of long-term debt is 10 per cent per annum, and the company's tax rate is 40 per cent. The market value of the long-term debt is the same as the carrying amount of the debt. The cost of the company's equity capital is 16 per cent, and the market value (and book value) of th e company's equity is S115 million. The following data relate to the two divisions of the Constructo Construction Company for the past year Operating profit before tax $32,000,000 29,000,000 Current Division Real estate Construction Total Assets Liabilities $150,000,000 $9,200,000 90,000,000 6,200,000 Required 1. Calculate the weighted average cost of capital of Constructo Construction Company. (Round your final answer to 3 decimal places.) hted average cost 2. Calculate the economic value added (EVA) for each of Constructo Construction Company divisions. (Round your weighted-average cost of capital to 3 decimal places (i.e..123). Enter your answers in millions rounded to 3 decimal places i.e. 1,234,000 should be entered as 1.234) Economic value added (in millions) Division Real Estate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts