Question: The continuously compounded annual return on a stock is normally distributed with a mean of 12% and standard deviation of 30%. With 95.44% confidence, we

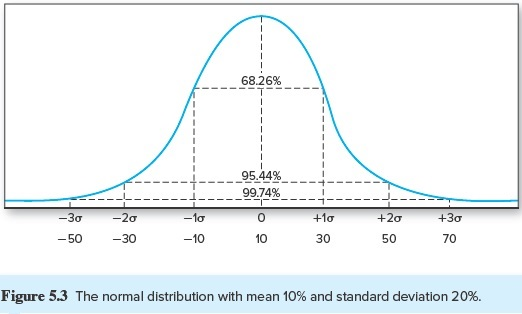

The continuously compounded annual return on a stock is normally distributed with a mean of 12% and standard deviation of 30%. With 95.44% confidence, we should expect its actual return in any particular year to be between which pair of values? Hint Refer to figure 5.3. O-48.0% and 72.0% 0-30.0% and 72.0% O-78.0% and 102.0% O-18.0% and 42.0% 68.26% - - - - _95.44% 99.74% - - - i ---- - -10 +10 -30 -50 -20 -30 ------ +20 +30 5070 - 10 30 Figure 5.3 The normal distribution with mean 10% and standard deviation 20%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock