Question: The controller has asked you to examine differeat distribution methods for applying factory overhead to the various production orders that are processed during a

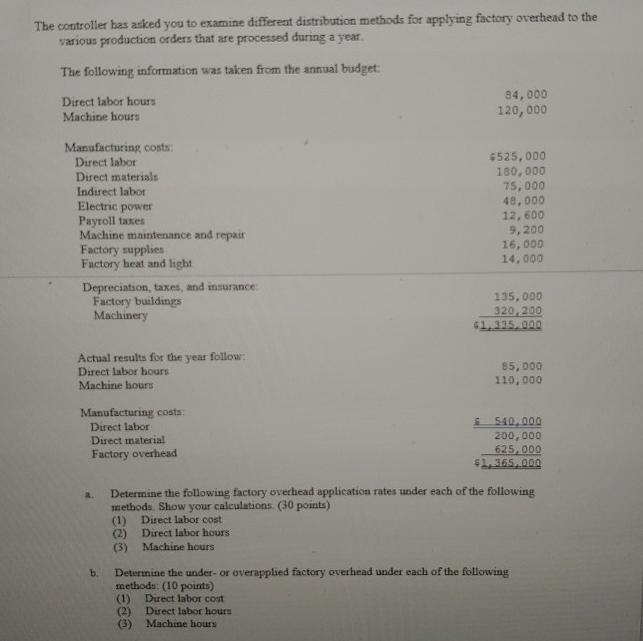

The controller has asked you to examine differeat distribution methods for applying factory overhead to the various production orders that are processed during a year. The following information was taken from the annual budget 84,000 120, 000 Direct labor hours Machine hours Manufacturing costs: Direct labor Direct materials $525, 000 180,000 75, 000 48,000 12, 600 9,200 16,000 Indirect labor Electric power Payroll taxes Machine maintenance and repair Factory supplies Factory heat and light 14,000 Depreciation, taxes, and insurance Factory buildings Machinery 135, 000 320,200 41,335, 000 Actual results for the year follow: Direct labor hours 85,000 110, 000 Machine hours Manufacturing costs: Drect labor Direct material Factory overhead 540, 000 200, 000 625,000 $1,365, 000 Determine the following factory overhead application rates under each of the following methods. Show your calculations. (30 points) Direct labor cost (1) Direct labor hours (2) (3) Machine hours Determine the under- or overapplied factory overhead under each of the following methoda: (10 points) Drect labor cost b. (1) Direct labor hours (2) (3) Machine hours

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Requirementa DL Cost Machine Hrs DL Direct Labor DL Hours 75000 48000 12600 9200 16000 14000 75000 4... View full answer

Get step-by-step solutions from verified subject matter experts