Question: The correct answer is -0.1. How do you get to that answer? The steps to calculate it are: 1. Compute the unlevered value of assets

The correct answer is -0.1. How do you get to that answer?

The correct answer is -0.1. How do you get to that answer?

The steps to calculate it are:

1. Compute the unlevered value of assets

2. Compute the levered value of assets according to the APV in the absence of bankruptcy costs.

3. Once you have the PV of backruptcy costs and their expected value in 15 years, you need to back out the discount rate and, applying the CAPM formula, the corresponding beta.

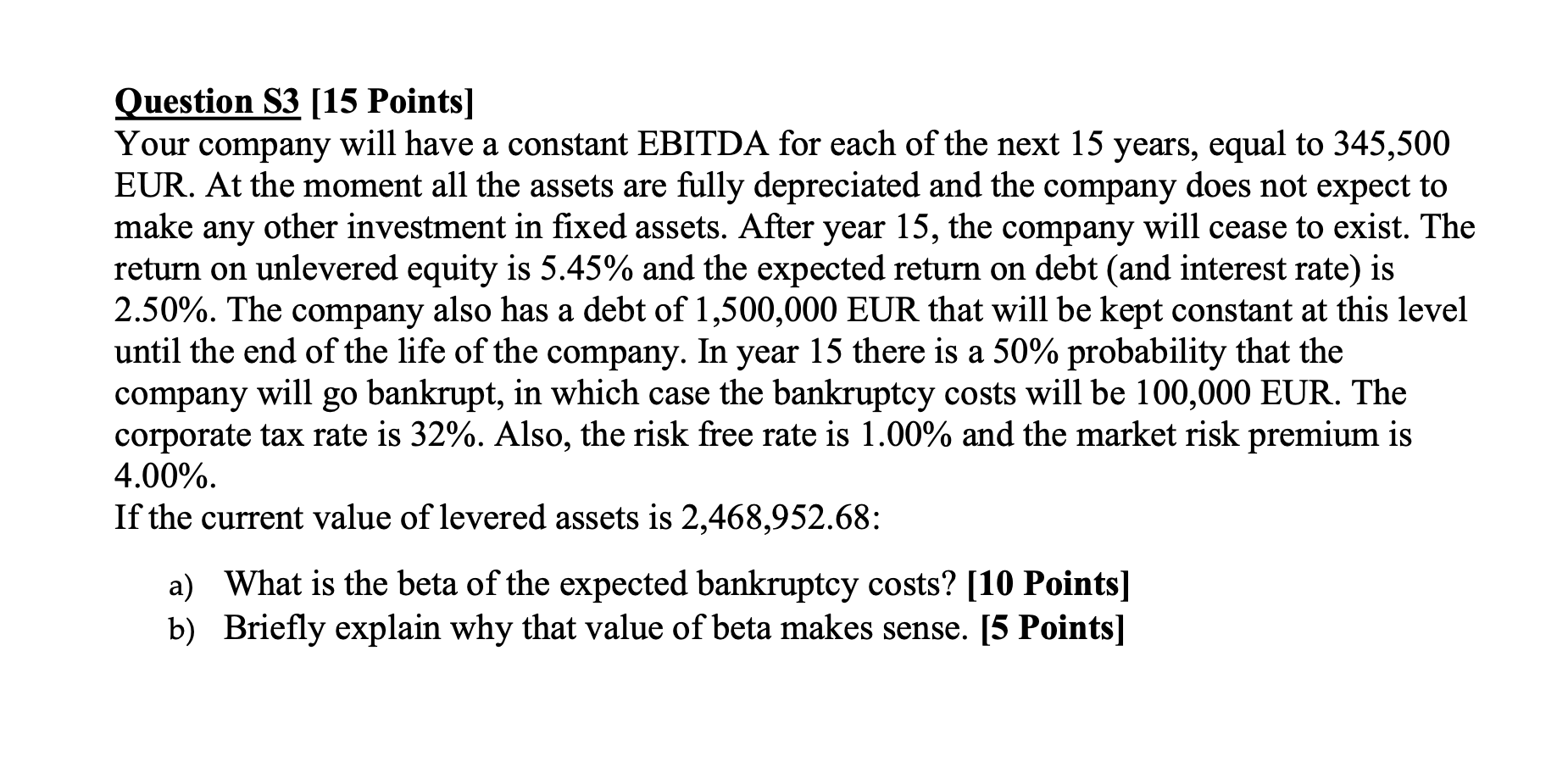

Question S3 [15 Points] Your company will have a constant EBITDA for each of the next 15 years, equal to 345,500 EUR. At the moment all the assets are fully depreciated and the company does not expect to make any other investment in fixed assets. After year 15, the company will cease to exist. The return on unlevered equity is 5.45% and the expected return on debt (and interest rate) is 2.50%. The company also has a debt of 1,500,000 EUR that will be kept constant at this level until the end of the life of the company. In year 15 there is a 50% probability that the company will go bankrupt, in which case the bankruptcy costs will be 100,000 EUR. The corporate tax rate is 32%. Also, the risk free rate is 1.00% and the market risk premium is 4.00%. If the current value of levered assets is 2,468,952.68: a) What is the beta of the expected bankruptcy costs? [10 Points] Briefly explain why that value of beta makes sense. [5 Points] b) Question S3 [15 Points] Your company will have a constant EBITDA for each of the next 15 years, equal to 345,500 EUR. At the moment all the assets are fully depreciated and the company does not expect to make any other investment in fixed assets. After year 15, the company will cease to exist. The return on unlevered equity is 5.45% and the expected return on debt (and interest rate) is 2.50%. The company also has a debt of 1,500,000 EUR that will be kept constant at this level until the end of the life of the company. In year 15 there is a 50% probability that the company will go bankrupt, in which case the bankruptcy costs will be 100,000 EUR. The corporate tax rate is 32%. Also, the risk free rate is 1.00% and the market risk premium is 4.00%. If the current value of levered assets is 2,468,952.68: a) What is the beta of the expected bankruptcy costs? [10 Points] Briefly explain why that value of beta makes sense. [5 Points] b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts