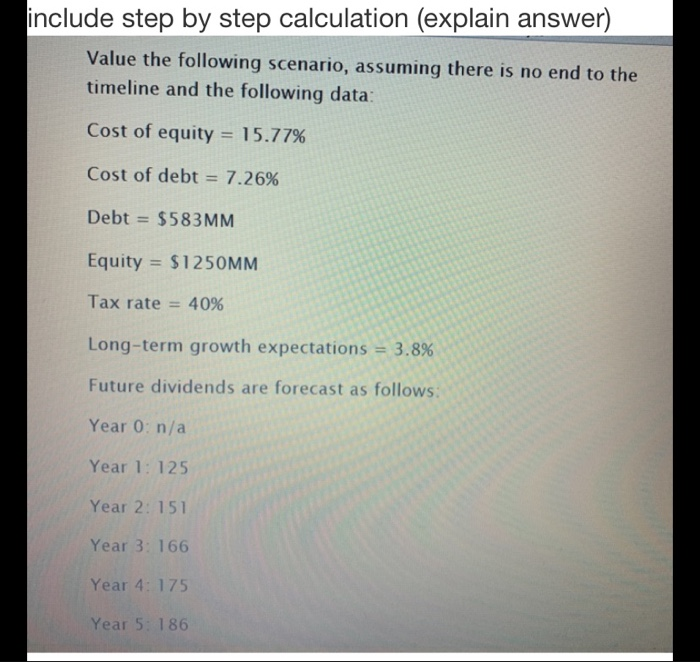

Question: the correct answer is 1209.08. explain how you got the answer include step by step calculation (explain answer) Value the following scenario, assuming there is

include step by step calculation (explain answer) Value the following scenario, assuming there is no end to the timeline and the following data: Cost of equity = 15.77% Cost of debt = 7.26% Debt = $583MM Equity = $1250MM Tax rate = 40% Long-term growth expectations = Future dividends are forecast as follows: Year 0: n/a Year 1: 125 Year 2: 151 Year 3: 166 Year 4: 175 Year 5: 186

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts