Question: The correct answer is 4767.2. Please show and explain all steps to solve. Thank you. There is a stock index futures contract maturing in one

The correct answer is 4767.2. Please show and explain all steps to solve. Thank you.

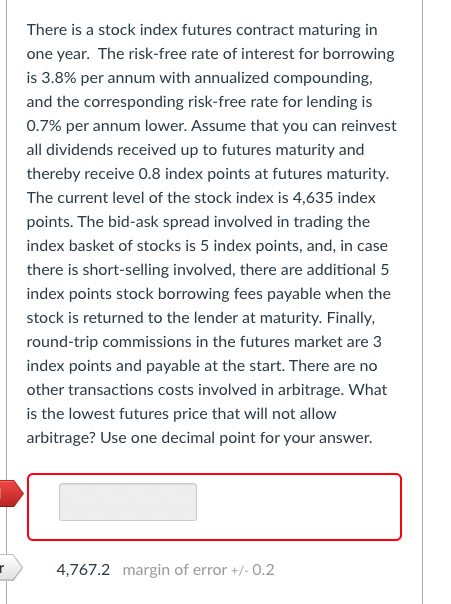

There is a stock index futures contract maturing in one year. The risk-free rate of interest for borrowing is 3.8% per annum with annualized compounding, and the corresponding risk-free rate for lending is 0.7% per annum lower. Assume that you can reinvest all dividends received up to futures maturity and thereby receive 0.8 index points at futures maturity. The current level of the stock index is 4,635 index points. The bid-ask spread involved in trading the index basket of stocks is 5 index points, and, in case there is short-selling involved, there are additional 5 index points stock borrowing fees payable when the stock is returned to the lender at maturity. Finally, round-trip commissions in the futures market are 3 index points and payable at the start. There are no other transactions costs involved in arbitrage. What is the lowest futures price that will not allow arbitrage? Use one decimal point for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts