Question: the correct answer is also given. i just need the procedure. Consider two asset classes: Stocks and Bonds. You estimate the following parameters for these

the correct answer is also given. i just need the procedure.

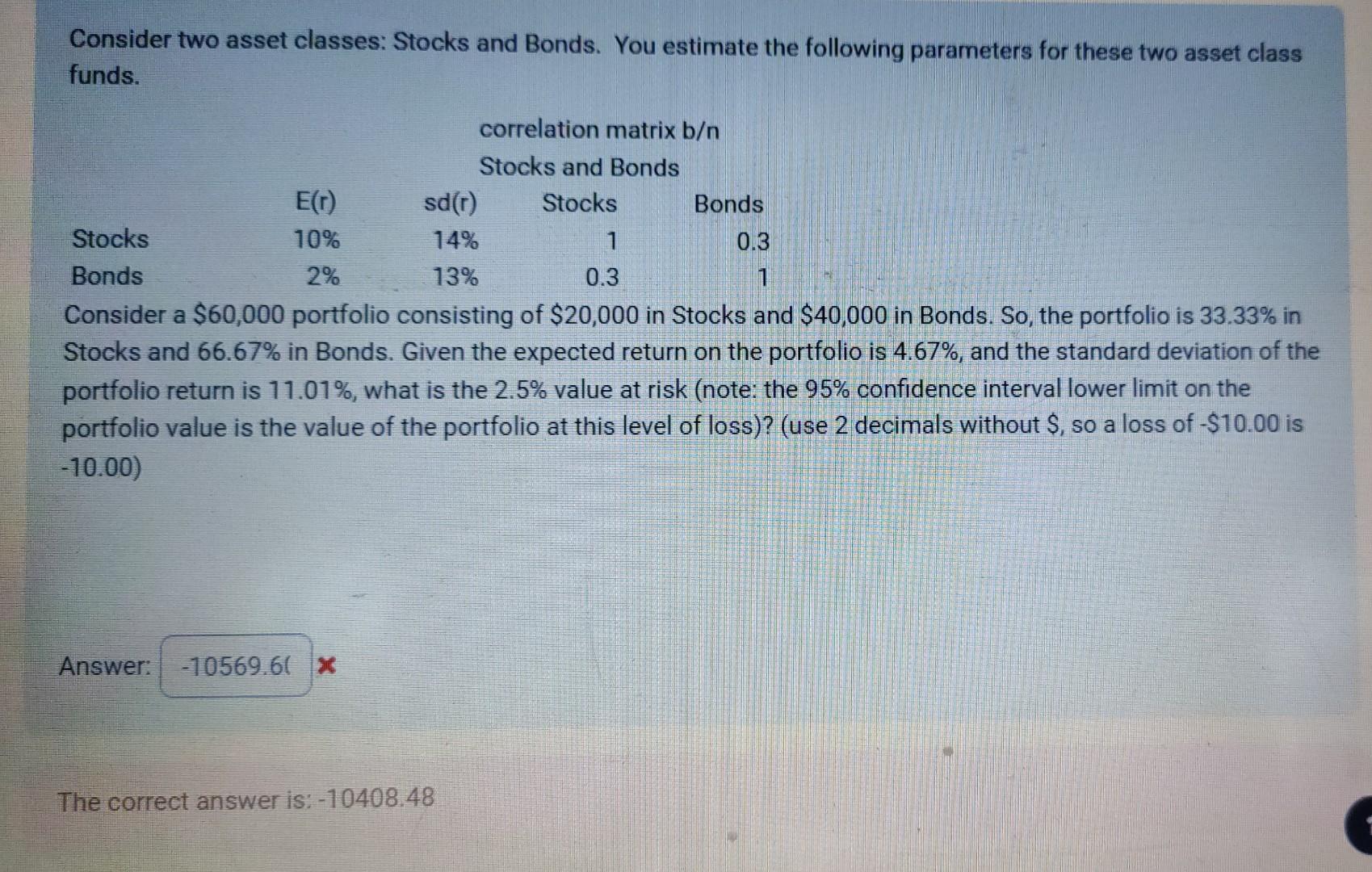

Consider two asset classes: Stocks and Bonds. You estimate the following parameters for these two asset class funds. Consider a $60,000 portfolio consisting of $20,000 in Stocks and $40,000 in Bonds. So, the portfolio is 33.33% in Stocks and 66.67% in Bonds. Given the expected return on the portfolio is 4.67%, and the standard deviation of the portfolio return is 11.01%, what is the 2.5% value at risk (note: the 95% confidence interval lower limit on the portfolio value is the value of the portfolio at this level of loss)? (use 2 decimals without $, so a loss of - $10.00 is 10.00) Answer: The correct answer is: -10408.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts