Question: the correct answer is c:12.29%. please explain these concepts in elementry terms not using excel. ive seen multiple explinations and i still dont get it.

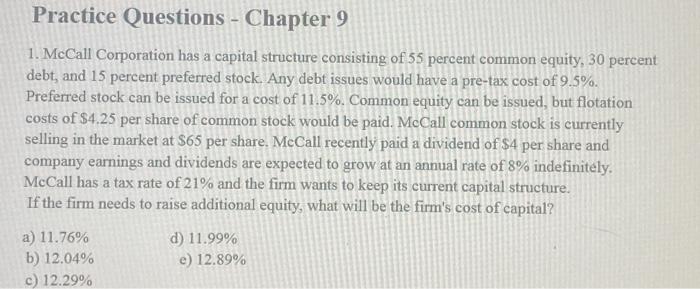

1. McCall Corporation has a capital structure consisting of 55 percent common equity, 30 percent debt, and 15 percent preferred stock. Any debt issues would have a pre-tax cost of 9.5%. Preferred stock can be issued for a cost of 11.5%. Common equity can be issued, but flotation costs of $4.25 per share of common stock would be paid. McCall common stock is currently selling in the market at $65 per share. McCall recently paid a dividend of $4 per share and company earnings and dividends are expected to grow at an annual rate of 8% indefinitely. McCall has a tax rate of 21% and the firm wants to keep its current capital structure. If the firm needs to raise additional equity, what will be the firm's cost of capital? a) 11.76% d) 11.99% b) 12.04% e) 12.89%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts