Question: The correct answer should be C. But I do not know how to get C 39) Duffs Beer common stock has a beta of 0.7

The correct answer should be C. But I do not know how to get C

The correct answer should be C. But I do not know how to get C

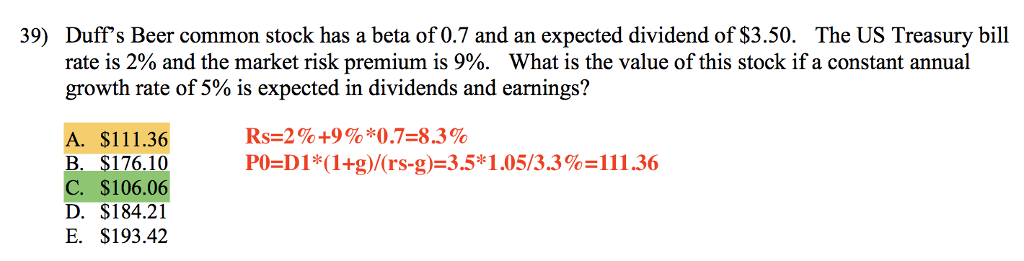

39) Duffs Beer common stock has a beta of 0.7 and an expected dividend of $3.50. The US Treasury bil rate is 2% and the market risk premium is 9%. What is the value of this stock if a constant annual growth rate of 5% is expected in dividends and earnings? Rs 2 % +9%*0.7-8.3% A. B. C. D. E. $111.36 S176.10 $106.06 $184.21 $193.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts