Question: the correct answers is not current liability or noncurrent asset. can you help please Pina Corporation began operations in 2025 and reported pretax financial income

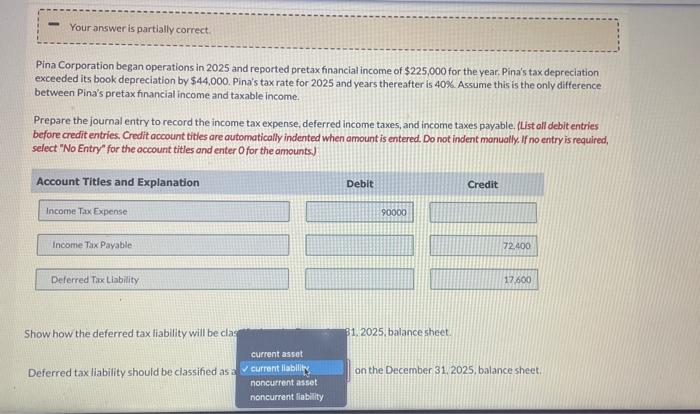

Pina Corporation began operations in 2025 and reported pretax financial income of $225,000 for the year. Pina's tax depreciation exceeded its book depreciation by $44,000. Pina's tax rate for 2025 and years thereafter is 40%. Assume this is the only difference between Pina's pretax financial income and taxable income. Prepare the journal entry to record the income tax expense, deferred income taxes, and income taxes payable. (List oll debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter Ofor the amounts) Show how the deferred tax liability will be cla 1.2025, balance sheet. Deferred tax liability should be classified as: on the December 31,2025 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts