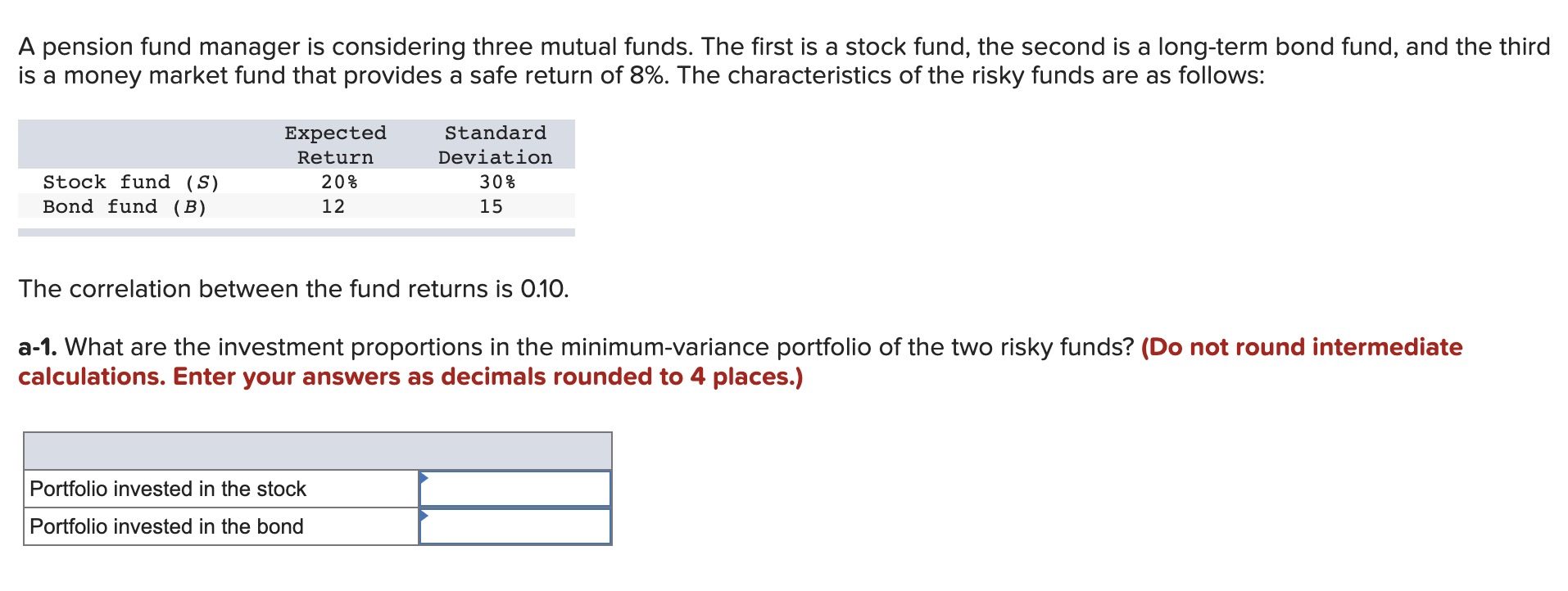

Question: The correlation between the fund returns is 0.10. a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds? (Do not

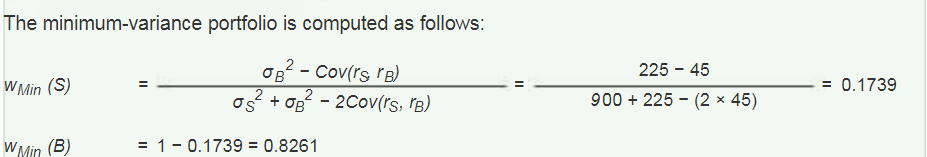

The correlation between the fund returns is 0.10. a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds? (Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.) a-2. What is the expected value and standard deviation of the minimum-variance portfolio rate of return? (Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts