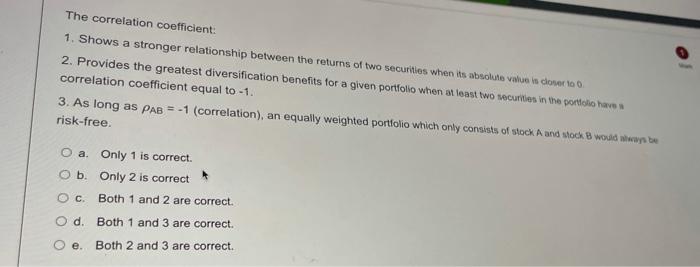

Question: The correlation coefficient: 1. Shows a stronger relationship between the returns of two securities when its absolute value in closer to 0 2. Provides the

The correlation coefficient: 1. Shows a stronger relationship between the returns of two securities when its absolute value in closer to 0 2. Provides the greatest diversification benefits for a given portfolio when at least two securities in the portoo have correlation coefficient equal to -1. 3. As long as PAB = -1 (correlation), an equally weighted portfolio which only consists of stock and stock 8 would www be risk-free O a. Only 1 is correct. O b. Only 2 is correct c. Both 1 and 2 are correct. O d. Both 1 and 3 are correct. Oe Both 2 and 3 are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts