Question: the corrext answer is 3414. how do i get there . In the current year J gifted shares of a public corporation to her son

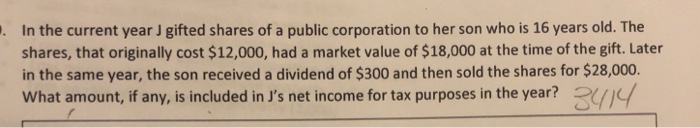

. In the current year J gifted shares of a public corporation to her son who is 16 years old. The shares, that originally cost $12,000, had a market value of $18,000 at the time of the gift. Later in the same year, the son received a dividend of $300 and then sold the shares for $28,000. What amount, if any, is included in J's net income for tax purposes in the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts