Question: The cost method is almost always used to record treasury stock purchases. This means that the corporation has purchased its own stock -- either from

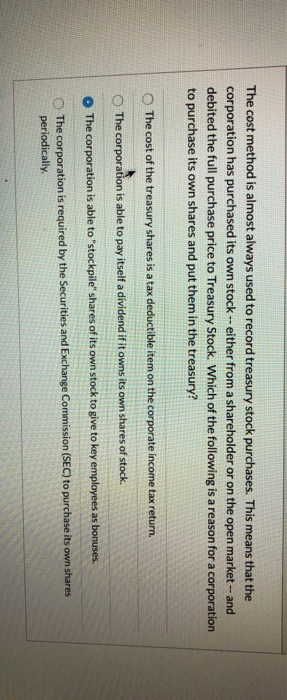

The cost method is almost always used to record treasury stock purchases. This means that the corporation has purchased its own stock -- either from a shareholder or on the open market -- and debited the full purchase price to Treasury Stock. Which of the following is a reason for a corporation to purchase its own shares and put them in the treasury? The cost of the treasury shares is a tax deductible item on the corporate income tax return. The corporation is able to pay itself a dividend if it owns its own shares of stock. The corporation is able to "stockpile" shares of its own stock to give to key employees as bonuses. The corporation is required by the Securities and Exchange Commission (SEC) to purchase its own shares periodically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts